Menu

Did you know in 2019, the U.K. made up 15% of the EU’s people and 17.6% of its money? This shows how Brexit affects both Europe and the U.S. due to livestock trade changes.

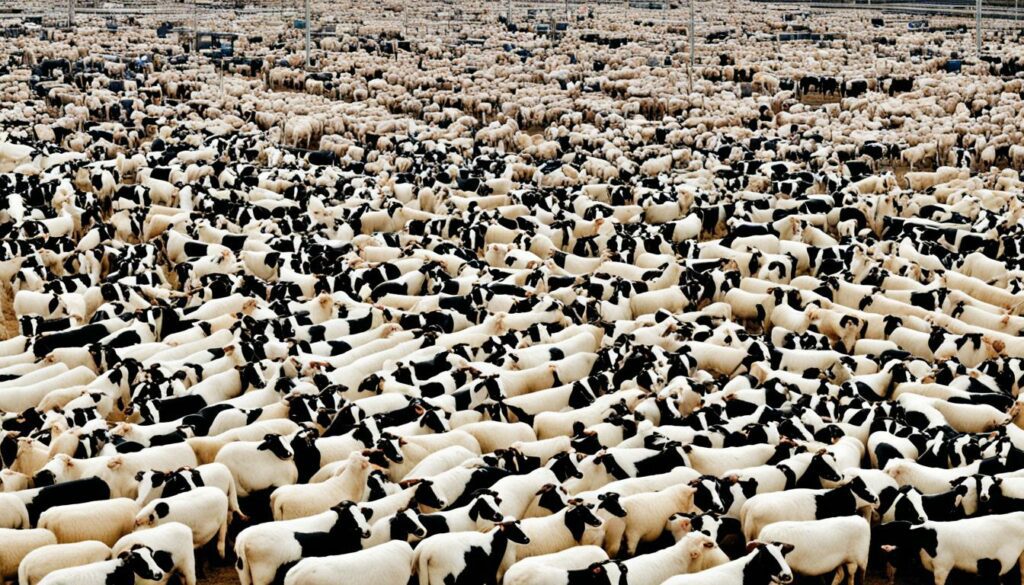

After the 2016 Brexit vote, the U.K. started to make new trade deals. As a result, in 2020, the U.K. made $34.2 billion from farming. Of this, $19.3 billion came from selling livestock products alone. The U.K. also bought $75.5 billion worth of farming goods but sold only $30.5 billion. This shows it mostly buys more than it sells in farming.

The U.S. is an important partner for the U.K., especially after Brexit. In 2020, the U.S. sold $2.7 billion in farming products to the U.K. This was about 1.8% of all U.S. farming exports. The U.K. sold $1.1 billion back to the U.S. During Brexit, the U.K. started trading more with countries outside the EU.

Even though it’s a small part of the bigger trade picture, the livestock trade between the U.K. and U.S. is crucial. Areas such as meat and whisky are significant between them. After Brexit, new rules have affected how goods move between the two countries. This has big effects on livestock trade, and it could change how the U.K. and U.S. work together in farming.

Brexit means the UK decided to leave the EU. This choice had a big impact on areas like farming and how livestock is traded. The UK was important in livestock trading worldwide and closely linked with the EU.

Before we discuss the effects and timeline, it’s key to understand why Brexit happened. This major change started in 2016 when the UK voted to leave the EU.

The UK’s exit from the EU has changed how it trades agricultural products. Before leaving, the EU supported the UK’s farming sector with a significant amount of money. For example, it provided €37.8 billion through the Common Agricultural Policy from 2010 to 2019.

This support shows the deep connection between the UK and EU in agriculture. The UK faced several challenges after Brexit, mainly regarding trade.

The Brexit timeline shows important steps in leaving the EU. It began in March 2017 with the UK formally stating its intention to leave. This started a two-year transition period.

This period ended when the EU-UK Trade and Cooperation Agreement was signed in December 2020. The agreement marked the new relationship between the UK and the EU.

Key moments in this timeline were the EU Referendum in 2016 and the formal declaration of leaving in March 2017. Negotiations were particularly intense from 2018 to 2019, leading to the UK’s official departure in January 2020. The final agreement was then reached in December 2020.

After Brexit, the UK faced new challenges in farming, especially in livestock trading. New trade rules impacted livestock health and the value of products. It also changed how the UK traded with the US.

In 2020, the UK imported $75.5 billion in goods and exported $30.5 billion. These numbers show how much the UK’s trading scene changed in a year.

| Year | UK Agricultural Imports | UK Agricultural Exports |

|---|---|---|

| 2020 | $75.5 billion | $30.5 billion |

| 2022 | $92.1 billion | $34.8 billion |

The new trade policies affected both the amount and type of livestock trade. In 2020, the US exported $2.7 billion worth of agricultural products to the UK. This example shows how Brexit changed UK and US agricultural relations.

After deciding to leave the EU, the UK has been working hard to adjust its trade relationships. The Trade and Cooperation Agreement with the EU is a key point in these efforts. It has opened up new ways for agricultural trade. Now, there are more places the UK can get imports from. Also, UK businesses can sell more to other countries.

The UK is now a major buyer of farm goods, importing $92.1 billion in 2022. It has signed deals with about 70 countries to boost its trade. This helps the UK trade more worldwide.

Deals have been made with important trade players like the EU, China, the US, and Brazil. The UK will also join the CPTPP by late 2024 and is talking to India. All these deals will make it easier for the UK to sell more products in more places.

After Brexit, there are now stricter rules on moving livestock, affecting trade with the EU and beyond. These rules include more checks and paperwork. This is a big change from when the UK was part of the EU.

The new rules also mean the UK must ensure its animals’ welfare while keeping trade smooth. This has led to changes in how livestock is moved around. The UK is working to follow these new requirements well post-Brexit.

| Year | UK Imports ($ billion) | UK Exports ($ billion) |

|---|---|---|

| 2022 | 92.1 | 34.8 |

After Brexit, the way the UK trades has really changed. In 2022, the country brought in $92.1 billion from agricultural goods and sent out just $34.8 billion. This shows how much the UK relies on food imports. It ranks fifth in the world for how much it brings in.

The UK used to mainly get farm goods from Europe. Now, it’s looking to trade more with other big countries like China, the U.S., and Brazil. For example, what the U.S. sells to the UK in farm products almost tripled from 1990 to 2022. Back then, it was $1.19 billion, now it’s reached $3.01 billion.

There’s also been a big increase in buying things like wood pellets for energy. Between 2010 and 2020, the U.S. saw its sales of forest stuff go up by 17.74% each year. By 2022, the U.S. was supplying most of the wood pellets the UK imports.

The change in what the UK buys has touched many areas. Importing more from outside the EU has added variety. For instance, more fresh veggies and tree nuts from the U.S. are coming in. This shows the UK is bringing in a wider range of items these days.

Looking at all this, it’s clear post-Brexit imports are making a big impact. More imports and more places to buy from show the UK is changing its trade game. This affects how farming works at home and whom the UK works with around the world.

| Year | Total Agricultural Imports (Billion $) | Total Exports (Billion $) | Key Import Partners |

|---|---|---|---|

| 2020 | $75.5 | $30.5 | EU, US, Brazil |

| 2022 | $92.1 | $34.8 | US, China, Brazil |

Brexit has given the UK a chance to set its own path in animal welfare. New policies are being put in place to make sure animals are treated well. The goal is to make the UK a leading example in caring for animals after leaving the EU.

The UK has brought in strict rules since Brexit. These standards aim to cover everything from how animals are born to when they are killed. There’s a focus on treating animals kindly and using ethical farming methods. A strong set of laws now need farmers to really care about animal well-being, especially before they are slaughtered.

Groups like the Humane Slaughter Association say there has been a big improvement in how animals are killed. They’re doing it in ways that cause less fear and pain, which follows what’s seen as the best methods globally.

The UK and EU have taken different paths in dealing with livestock since Brexit. Studies show the UK is toughening its rules more than the EU is. This means more checks on farms and stricter procedures when working with animals. The UK has been fast in addressing any shortcomings and making new, higher standards, reflecting its own values.

| Parameter | UK post-Brexit | EU |

|---|---|---|

| Slaughter Standards | Enhanced pain minimisation | Established but less frequent updates |

| Research on Living Animals | Increased oversight | Stable, unchanged |

| Inspection Frequency | More frequent | Regulated but less frequent |

So, looking at animal welfare after Brexit, the UK is really trying hard. It’s putting in more checks and keeping a close eye on how animals are treated. This shows the UK’s strong will to be a forerunner in good practices, proving it truly cares about ethical farming.

After Brexit, trade tariffs on livestock have caused big changes. We need to rethink our trading moves. This is to meet Great Britain’s economic goals and keep our farms strong against competition.

Current advice calls imports from the EU to the UK as risky. So, they must come with a health certificate. Animals and germinal products (except Irish ones) need to go through specific border control points. To keep things smooth, traders have to keep adapting how they operate.

Traders also must include certain documents with their goods. Live animals can arrive at any point, but horses must have their passports updated. Then, traders have to alert authorities a day before arrival via the APHA’s IPAFFS system. This helps keep a clear record of the journey.

| Category | Requirement |

|---|---|

| Live Animals | Health Certificate Required |

| Germinal Products (Excluding Ireland) | Relevant Border Control Post Entry |

| Equines | Updated Horse Passport |

| Export Documents | Commercial Document, Invoice, Packing List |

These tariffs hit the livestock market hard. The UK’s Global Tariff raised costs on beef and sheepmeat from the EU. For instance, beef from the EU has a 66% tariff, much higher than elsewhere. This makes Scottish lamb less appealing without special agreements.

These tariffs push up prices for both buying and selling meat. This affects income for farmers and changes things across the UK economy. Keeping an eye on trade policies and tweaking our strategies is vital to stay competitive and stable.

So, these new tariffs after Brexit have really changed the game for farmers. It’s important for everyone in the industry to understand and adapt to these new rules. This way, we can keep the livestock market in Great Britain strong.

The Brexit deal changed the game for UK meat exports. New rules brought in strict checks and tariffs. This move was vital after Brexit to fit the new trade picture.

In 2022, the UK became the fifth-biggest buyer of farming products, bringing in $92.1 billion. It sold $34.8 billion. The Brexit deal mainly aimed at meat export limits. This involved tougher health checks and tariffs. The goal was to raise the quality of UK meat for the world market.

Numbers show the US sending more farming goods to the UK over time. From $1.19 billion in 1990, it hit $3.01 billion in 2022. But, Brexit rules like extra checks and certifications have made trading harder. This is especially tough for small businesses, with more paperwork and costs.

| Indicator | Value in 2022 |

|---|---|

| US Agricultural Exports to UK | $3.01 billion |

| UK Agricultural Imports | $92.1 billion |

| UK Agricultural Exports | $34.8 billion |

| US Forest Products to UK | $1.28 billion |

| UK Wood Pellet Imports (US contribution) | 64% |

Furthermore, the UK’s new meat export limits affect the world’s meat trade too. Meeting global standards is now more important than ever. UK meat exporters must be quick to change and find new ways as they deal with the Brexit deal.

Brexit has hugely changed farming, affecting its economy and who works in it. The financial scene for UK farmers has shifted a lot. This is because Brexit changed how subsidies, trade deals, tariffs, and market access work.

After Brexit, the farm economy was hit by many changes. In 2019, the UK made up 15% of the EU’s people but produced 17.6% of its money. Farming alone brought in $34.2 billion in 2020, with livestock making $19.3 billion.

“The U.K. agricultural sector received €37.8 billion from the EU’s Common Agricultural Policy between 2010 and 2019, reflecting its integration within EU frameworks,” cited an industry analyst.

Brexit also made trade with the U.S. look different. In 2020, the U.S. sold $2.7 billion in farm goods to the UK. The UK bought $1.1 billion back. This change shows complex economic ties and trade needs.

After Brexit, finding workers has been hard for UK farms. Many workers were from abroad but new rules have made it difficult to keep them. This has slowed work and made farms less efficient.

Experts say, with a Brexit deal, farm profit could drop from £93 to £68 per hectare. But, with no deal, it might go as low as -£45. This shows how tied labour and money problems are after Brexit.

| Economic Factor | Pre-Brexit | Post-Brexit Impact |

|---|---|---|

| U.K.’s contribution to EU GDP | 17.6% | Diminished influence |

| Farm output (2020) | $34.2 billion | Subject to new trade terms |

| Exports to US (2020) | $2.7 billion | Potential growth or decline |

| Imports from the US (2020) | $1.1 billion | Market shifts |

| Farm profitability per hectare | £93 to £68 | -£45 in no-deal |

“`

This is the end of Section 8. It shows how Brexit has affected farming’s money and who works there. It uses a serious tone and lots of facts to explain the current farm situation because of Brexit.

The UK and US have a strong history in sharing agricultural products. This relationship has changed over time, matching new economic and consumer needs. Lately, how these countries trade has seen big changes.

The story of UK-US livestock trade is filled with ups and downs. In 2020, the U.S. sold nearly $2.7 billion worth of farm goods to the UK. This made up 1.8% of all the U.S. agricultural sales. Products like tree nuts went up by 10.84% to $197 million. Spirits, like whiskey and gin, have always been strong, with the UK buying $1.1 billion worth.

Recently, certain goods have really grown in trade between the UK and the US. For example, wood products grew 17.74% each year over the past decade, hitting $925 million by 2020. Food preparations and fresh vegetables also increased a lot, to $155 million and $84 million, respectively.

In the future, there are high hopes for UK-US trade. The UK is looking to trade with more places after Brexit. The US wants to sell more eco-friendly products. As a result, we may see more high-value goods traded and an increase in products like essential oils. These were up by 1.14% to $89 million in 2020.

| Category | Export Value (2020) | Growth Rate |

|---|---|---|

| Forest Products | $925 million | 17.74% |

| Alcoholic Beverages | $328 million | 0.92% |

| Tree Nuts | $197 million | 10.84% |

| Food Preparations | $155 million | 18.64% |

| Essential Oils | $89 million | 1.14% |

| Fresh Vegetables | $84 million | 11.33% |

This future trade is expected to grow, especially in valuable sectors and new farm goods. It shows how important it is to keep and improve trade ties. This benefits the economies of both countries.

The decision to leave the European Union, known as Brexit, has changed how we trade. It’s brought new steps in customs and border checks. These steps are key for smooth trade, especially for items like livestock.

One big change from Brexit is the need for more customs and border checks. Before, it was easier for the UK to trade with the EU. But now, there are more checks at borders.

The 2018 Agreement from the EU laid out new border control rules. These rules mean more thorough checks and a lot of paperwork. This can slow down trade and cause delays.

After Brexit, there’s more paperwork to trade. Companies have to work harder to meet UK and global standards. For example, the UK-Australia deal means more rules to follow.

In 2019, the US mentioned that trade with the UK would need a lot more documents. As the UK makes new deals, they’ll have to keep up with even more rules. This makes trading more complex.

In conclusion, Brexit has deeply changed how we trade. It has made customs and border checks more detailed. It also means there’s a lot more paperwork to do. The future of trading will need careful planning to keep livestock trade moving smoothly.

The Northern Ireland Protocol is key in the Brexit deal. It changes how livestock moves between Northern Ireland, the EU, and the rest of the UK. This deals with different rules and how goods move. I’ll explain key parts of how this affects livestock trading post-Brexit.

Livestock like cattle, sheep, and pigs must stay at their farm for 40 days after Brexit. They can’t be moved to the EU or Northern Ireland before this time. This is because of stricter biosecurity rules.

The EU has over 400 Border Control Posts (BCPs) at places like ports. They check that livestock and poultry have the right paperwork. Animals without paperwork might not be allowed in the EU or Northern Ireland.

If animals fail health checks, they are destroyed. But, some might be allowed back into the UK. This is after a risk check at an EU BCP.

For animal travel, EU documents are now needed instead of UK ones. For export outside the EU, an Export Health Certificate (EHC) is also required.

When goods move between Northern Ireland and non-EU places, an EORI number starting with XI helps. Goods going to Great Britain through Ireland must follow Irish customs. This shows the complex trade rules.

Trading pets and animal products to Northern Ireland must meet certain requirements. This includes health checks and import declarations.

| Aspect | Details |

|---|---|

| Holding Period | 40 days at origin premises |

| BCPs in the EU | 400+ locations at ports and airports |

| Documentation Requirement | Crucial for EU/Northern Ireland entry |

| Health and Safety Checks | Failed checks result in immediate destruction |

| Re-entry to Great Britain | Permitted after risk assessment |

| EU-issued Documents | Necessary for direct transportation from Great Britain |

| EHS & Supporting Documents | Required for non-EU country exports |

| EORI number (starting with XI) | Required for movement between Northern Ireland and non-EU countries |

| Import Declarations | Not required for qualifying Northern Ireland goods to Great Britain |

The Northern Ireland Protocol creates a new trade system. It balances different rules but still allows smooth livestock movements.

After Brexit, the UK’s food and livestock sectors faced big changes. These changes relate to new trends and how people see animal welfare. As the economy changes, consumers’ views and spending habits also change.

Brexit has made consumers less sure about the future. The UK Agriculture Bill 2017-2019 is a big part of this change. It wants to replace more than 26 billion EUR from the EU. This could spell trouble for food prices because the UK gets 60% of its food from elsewhere.

The way EU payments have moved, changing spending in the UK, shows these shifts. For example, 70% of extra money is going to England. With over 450,000 workers, the UK’s food and drink sector has seen a drop in demand.

How people view animal welfare after Brexit is really important. 80% of our laws on this came from the EU but could now change. There are new bills to make laws tougher and closer to what consumers want.

But, Brexit made it harder to agree on laws with the EU. This has led to less EU imports and a big effect on what people buy. Maintaining trust by being clear about animal welfare is key. This helps to keep people choosing products that meet high welfare standards.

The future for UK-US agricultural trade looks bright, even with Brexit challenges. The export value of U.S. agricultural goods to the U.K. doubled to $3.01 billion in 2022 from $1.19 billion in 1990. This steep growth shows a strong and growing trade bond despite changes.

The U.S. leads in sending fuel ethanol to the U.K., making $162 million in 2022. It also provided 64% of the U.K.’s wood pellet imports that year. These numbers show how much the countries rely on each other in trade.

But, alcohol sales tell a different story. U.S. alcoholic drinks to the U.K. grew by 2% yearly, but dropped after 2015 due to 2018 tariffs. U.K. alcohol exports to the U.S. grew by 4.2% yearly. They fell by 18.4% during COVID-19 but jumped 27.6% in 2022. This shows trade’s ups and downs.

Brexit has changed how the UK’s farms operate. This includes how they trade, who they trade with, how they’re funded, and the rules about looking after animals. Import and export rules have also changed.

The UK-EU Trade agreement brought in new border rules. Livestock movement now needs extra checks and paperwork. This makes moving animals between the UK and EU countries harder.

Since Brexit, the UK is buying more food from places like China, the US, and Brazil. They’re looking to buy different kinds of food from around the world.

Brexit let the UK make its rules on how to treat animals. These rules might be stricter than the EU’s. It affects how animals are cared for and how they’re traded.

After Brexit, there are new taxes on livestock trading. Farmers need to plan carefully to stay competitive. These changes aim to protect UK farmers in the world market.

The Brexit deal changed how the UK can sell meat abroad. Deals were made on how clean and safe the meat must be. These changes affect global meat trading.

After Brexit, many money matters influenced farming in the UK. This includes changes in how farms are funded, what they can sell, and the places they can sell to. There are also new taxes.

Trade between the UK and US is growing. More US products like wood pellets and fresh vegetables are coming to the UK. New trade deals are expected to bring even more goods based on what customers want.

Since Brexit, checking goods at borders has become stricter. This makes moving goods harder. There could be more delays because of all the new rules.

The Northern Ireland Protocol brings special rules for moving animals in and out of Northern Ireland. It makes a special trade area for animals.

After Brexit, animal welfare laws have changed. Buyers care more about where their food comes from and how the animals were treated. This affects the food they choose.

Trade between the UK and US looks hopeful, but there are some unknowns. New trade talks might bring good chances, even with some unclear rules.