Menu

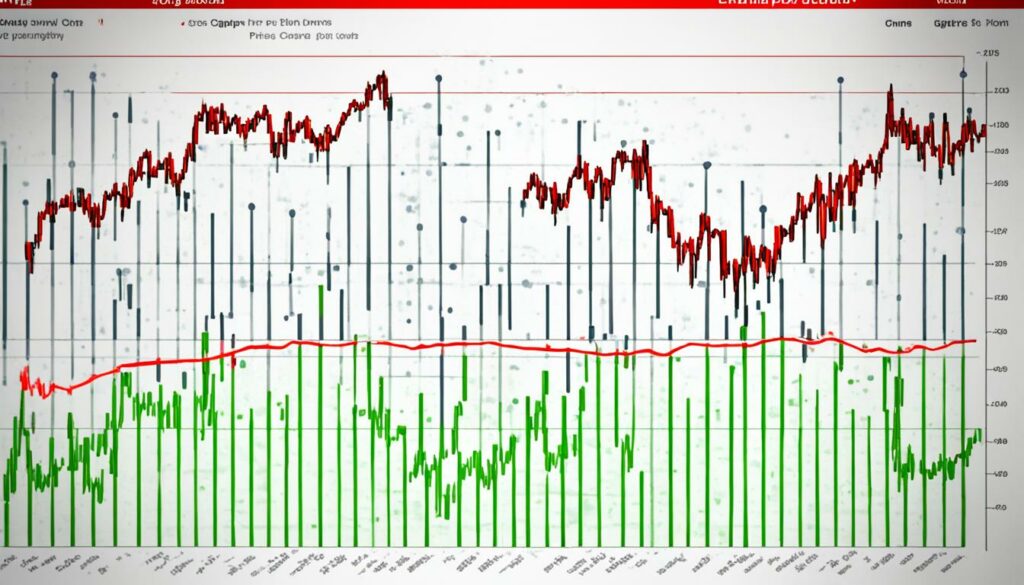

Did you know that in 2023, commodity prices went up by only 0.8%? This is quite low compared to 2021, when prices increased by 12.1%. It’s also lower than the 4.8% rise in 2022. This shows a big change in market trends and economic signs.

By 2024, the trend shifted. Commodity prices started to increase, leading to inflation. This change is a U-turn from 2023, when prices were falling for energy, agriculture, and metals. Better global economic conditions and less supply of commodities pushed some prices up.

Commodities impact the U.S. Consumer Price Index (CPI) a lot. Energy makes up about 7% of this index, and food is over 13%. While some commodities don’t affect the Federal Reserve’s policies much, recent oil price increases have stopped inflation from going down.

In 2023, commodity prices only slightly increased by 0.8%. This small rise was very different from the big jumps seen in the past. Energy prices were very changeable, with crude oil prices swinging after the pandemic and due to world events.

These included the Russia-Ukraine conflict, tensions in the Middle East, and actions by OPEC+. These changes show how closely linked world events, economy, and investment choices are.

Commodities are vital for the world’s economy. They’re the raw materials that make everyday items. This includes things like wheat, oil, and gold. Over the years, how we trade these goods has changed a lot, thanks to new ways like futures trading and funds.

Commodities make up a big part of what we pay for things in the U.S. About 36% of the Consumer Price Index (CPI) is from them. This includes 7% for energy and 13% for food. In 2023, prices for these materials went up by just 0.8%. This is a small rise, especially compared to the jumps seen in 2021 and 2022. Between January 2023 and February 2024, prices hardly changed, only ticking up by 0.3%.

Buying commodities is a smart move to fight inflation. It helps spread out risk because their value doesn’t follow the same pattern as stocks and bonds. These items are mainly sold through futures contracts. These let sellers and buyers set a price now for delivery later. But keep in mind that the prices can shift a lot due to many factors, such as how much is available and events around the world. So, it’s very important that investors understand these markets well and can predict prices.

Annualised Commodity Price Changes:

| Year | Percentage Change |

|---|---|

| 2021 | 12.1% |

| 2022 | 4.8% |

| 2023 | 0.8% |

| 2024 | 0.3% (Ending February) |

To work well in the market, it’s important to understand all types of commodities. This includes both the hard stuff like metals and oil, and the softer, like fruits and cotton. The more we know about these materials and how to invest in them, the better we can handle our finances.

Looking into the importance of commodity prices in the economy shows their effect on inflation, consumer spending, and how stable the economy is. Commodities make up a big part of the Consumer Price Index (CPI), so changes in their prices are closely watched by leaders and investors. This helps show where the economy is heading.

In 2023, raw material prices only increased by 0.8%. This was after big jumps, like 12.1% in 2021 and 4.8% in 2022. Commodities make up roughly 36% of the CPI, with food and energy being over 20% of that. Since October 2023, the price changes of commodities have stayed under 1%. Even with these small increases, inflation stayed over 3%, leading to the Federal Reserve keeping interest rates high.

Some commodities, like crude oil and gold, can change drastically in price. For example, crude oil prices moved from above $100/barrel in April 2020 to over $120/barrel later, but then stayed between $70 and $90/barrel. Gold prices went from $2,057/ounce in May 2023 to $1,831/ounce in October, then up to nearly $2,200/ounce by March 2024. These big changes show how hard it can be to predict commodity prices.

Commodity prices have a big impact on global trade and the wider economy. They help indicate inflation because they’re so important in many sectors. Food costs rose by 2.2% for the 12 months ending in February 2024, lower than the overall inflation rate of 3.2%. This directly shows how consumers and economic policies are affected.

Over the last thirty years, the link between commodity prices and inflation has changed. Factors like globalisation and exchange rate changes play a big part in this relationship. Even though raw material prices are watched closely, they don’t drive inflation as much as they did in the 1970s. Still, commodities are key for spreading out risk and fighting inflation, making their prices important for planning the economy and investment.

| Year | Commodity Price Change | Inflation Rate | Key Events |

|---|---|---|---|

| 2021 | +12.1% | 4.7% | Economic Recovery Post-COVID |

| 2022 | +4.8% | 5.5% | Supply Chain Disruptions |

| 2023 | +0.8% | 3.2% | Political Tensions, Market Adjustments |

| 2024 (Feb.) | +0.3% | 3.2% | Federal Reserve’s High Interest Rates |

Commodity prices are not simple. They change for many reasons. Economic growth, tech progress, and big world events all have an impact. It’s important to know how supply and demand dynamics work. This understanding is key for investors and policymakers.

The balance of supply and demand sets the prices. When there’s a lot available but not many want it, prices drop. This was seen when WTI crude oil hit $18 a barrel on April 20, 2020, as people used less gasoline worldwide. Or when bad weather in Brazil in April 2021 caused coffee and corn prices to rise. A drought and frost destroyed harvests, making supply scarce.

Key economic signs help us understand commodity prices. Things like inflation, GDP growth, and jobs numbers tell us how the economy is doing. They shape how much people buy and invest in commodities. The Russia-Ukraine conflict has affected the making of coal, oil, gas, wheat, and aluminium. This shows how economic health and commodity prices are tied together.

Big political moves, like sanctions on Venezuela, limit oil production. This influences the entire market. The cost of moving goods can also change prices. When there’s too much oil, for instance, and tankers are used as storage, the cost of shipping increases.

| Event | Impact on Commodity Prices |

|---|---|

| Brazil Drought and Frost (April 2021) | Spike in Coffee and Corn Prices |

| Russia-Ukraine Conflict (February 2022) | Disruptions in Coal, Crude Oil, Natural Gas, Wheat, and Aluminium Markets |

| Venezuela Oil Sanctions | Constraints on Oil Production and Market Adjustments |

| Global Lockdowns (April 2020) | Drastic Drop in WTI Crude Oil Prices |

How the economy and market trends mix is complex. This shows us how deeply connected these factors are. To sail through these markets, you need to understand today and yesterday. All these aspects together shape the bigger scene of commodity pricing.

Commodity prices constantly change in global markets. This happens due to seasonal needs, cuts in production, and politics. For example, changes in oil prices reflect OPEC+ decisions.

In 2023, prices went up by just 0.8%. This is much less than the 12.1% growth in 2021 and the 4.8% in 2022. Economic data from the U.S. Bureau of Labor Figures showed a 0.3% increase until February 2024.

Gold prices showed big ups and downs during the year. They hit $2,057/ounce in May 2023, then fell to $1,831/ounce in October. But by March 2024, they were back up near $2,200/ounce.

Since October 2023, annual price changes have been under 1%. Since April 2023, they have stayed under 2%. This shows a relatively steady market. However, food costs jumped by 2.2%, which is more than the general inflation of 3.2%.

| Year | Commodity Price Change (%) | Overall Inflation Rate (%) |

|---|---|---|

| 2021 | 12.1 | 5.4 |

| 2022 | 4.8 | 8.6 |

| 2023 | 0.8 | 6.5 |

| 2023-2024 | 0.3 | 3.2 |

To understand these changes, we need to look at key economic signs. For example, inflation peaked at 9.1% in June 2022 but fell to 3.2% in February 2024. Commodities are about 36% of the Consumer Price Index, showing they are crucial for measuring the economy.

Commodity prices have shown an annual volatility of between 10% and 20% over four years. They can even swing by up to 70% of the average price of the year, as noted by McKinsey. Companies use strategies like financial hedging and supply management to deal with these risks.

It’s key for leaders and investors to grasp how global trade affects commodity prices. Commodities make up about 36% of what we spend (CPI). Energy is 7% and food is over 13%. These numbers show how global trade changes can impact prices across the board.

Events like wars can really change commodity prices. The Russia-Ukraine conflict hit the grain markets hard, causing costs to rise. Gold, reaching $2,057/ounce in May 2023, is an example. Market uncertainty often leads investors to valuable metals. These events show how much global politics can shake up trade.

Trade deals and rules also cause prices to shift. OPEC+ choices on oil production kept crude oil prices between $70 to $80/barrel. When exports boom, especially due to financial shocks, prices and the economy can quicken. Pacts like NAFTA have affected food and factory goods supply and cost. This proves that solid trade rules are vital for steady markets and economies.

| Commodity | Component to CPI | 2023 Price Change | 2024 Price Change |

|---|---|---|---|

| Energy | 7% | 0.8% | 0.3% |

| Food | 13% | 2.2% | 3.2% |

| Gold | – | $2,057/ounce | $2,200/ounce |

Global trade holds the commodity market together. Knowing about political events and deals is vital to predict price changes.

Energy prices, especially crude oil, are key to understanding the world economy. They show how well the global economy is doing. When global financial activities are healthy, we see energy prices rise. This affects what consumers pay and can lead to higher inflation.

For example, when the Ukraine was invaded, the cost of a barrel of oil surged past $120. But, by the end of 2023, it had settled around $70 to $80. However, by March 2024, prices went over $80 per barrel again. These ups and downs reveal a lot about the energy industry’s complex nature.

Price forecasting for energy commodities considers many influences on the market. Big events like wars in the Middle East can disrupt supply chains. This then affects energy prices.

These effects are important for both policymakers and the public. When energy prices go up, it often leads to inflation. So, understanding these broader impacts is key.

Take a look at some key trends in commodity prices over recent years:

| Time Period | Commodity Price Change | Key Events |

|---|---|---|

| 12 Months Ending Feb 2024 | 0.3% Rise | Stabilising market trends |

| 2023 | 0.8% Increase | Economic recovery post-pandemic |

| 2022 | Up to 50% Rise in Energy Prices | Geopolitical tensions |

Changes in commodity prices can affect many areas of the economy. Since commodities are about 36% of the Consumer Price Index (CPI), these changes matter a lot. Energy alone makes up 7% of this figure. So, changes in energy prices can lead to big shifts.

For instance, the need for more oil in the summer can push prices up. Also, investing in oil pipelines can change the game. It’s clear the economy’s health is tied to energy prices. That’s why we need to carefully watch and understand them.

Agricultural commodity prices go up and down a lot due to various reasons. Weather and climate factors are key, affecting the amount of goods produced, thus changing the market. In the past, dry seasons in Australia and failed harvests in Europe. These led to big shifts in grain exports.

Weather and climate factors greatly impact agriculture. Let’s look at wheat, corn, and soybeans. Prices rose in summer 2023 because of bad weather but fell once conditions improved. This shows how sensitive agricultural markets are to weather changes.

Biofuel policies also have a big effect on prices by lowering wheat and maize stocks worldwide. This highlights the importance of paying close attention to policy’s role in the agriculture sector.

New agricultural technologies help manage risks from weather and climate factors. Thanks to innovative farming methods and genetic crops, farmers can get better at dealing with tough situations. This means that they can keep their production steady, even when facing challenges.

From 2006 to 2007, global oilseed production went up by 5.4%, but then it dropped by 3.4% the next year. These changes show how technology and the weather can affect farming results.

| Year | Global Grain Production Change | Global Oilseed Production Change |

|---|---|---|

| 2006 | -1.3% | +5.4% |

| 2007 | +4.7% | -3.4% |

In conclusion, keeping an eye on agricultural commodities in light of technology and climate is vital. Using technology helps farmers deal with risks and ensures a steady production. This acts as a safety net against the unpredictability of the weather and market changes.

The prices of both industrial and precious metals change based on how much they’re wanted. This is mainly in areas like technology and making things. With more electric cars being made, metals like cobalt, lithium, and nickel are needed for their batteries. This has made the cost of these metals jump as companies race to get enough.

As technology gets more advanced, the need for metals grows. More electric cars, phones, and other gadgets mean we need a lot of copper, aluminium, and rare earths. There’s also been more money spent on making energy clean recently. This means even more metals are being used in things like solar panels and wind turbines.

Prices for precious metals, especially gold, change a lot. Gold is seen as a safe bet against inflation. Its price went from $2,057 an ounce in May 2023 to $1,831 in October. By March 2024, it was almost back to $2,200. Many people invest in precious metals to keep their money safe during times of change.

Both industrial and precious metals are very important for making things and for watching the economy. So, understanding how they are priced is key for both those who make them and those who buy them.

| Year | Gold Prices ($/ounce) | Oil Prices ($/barrel) | Copper Prices ($/ton) |

|---|---|---|---|

| 2023 (May) | 2,057 | 70-80 | 8,900 |

| 2023 (October) | 1,831 | Above 90 | 8,300 |

| 2024 (March) | Just below 2,200 | 80+ | 9,200 |

The link between commodity price impacts and inflation is complex. It includes several economic indicators. The costs of goods and services went up a lot in the 1970s when oil prices rose. This increase in oil prices affected the cost of many things because oil is used in lots of sectors.

In the last 30 years, this connection has become less straightforward. Due to globalisation, the link between commodity price impacts and inflation is more tangled. For example, a strong dollar can lower domestic prices as it makes international goods cheaper.

Looking at specific types of commodities reveals important trends. Commodities like precious metals, agricultural goods, and oil and gas play unique roles. They can change our expectations about inflation due to events like natural disasters. These events may disrupt the supply chain, raising costs and affecting the economy.

From January 1995 to December 2019, there was a strong link between changes in commodity prices and inflation. For instance, the average correlation between these changes and headline inflation was usually 0.7. However, this link could be stronger for energy prices than for metals or food prices. This shows that different commodities affect inflation in varying ways.

| Year | Average Correlation (Commodity Price Changes & Headline PCEPI) | Largest Annual PCEPI Increase |

|---|---|---|

| 1995-2019 | 0.7 | 4.2% (2021) |

| 2020-2021 | 0.47 (Core Inflation) | 38% (Average Index Growth) |

| 2010-2020 | 0.06 (Trimmed-mean Inflation) | Negative Correlation in Some Cases |

The table above shows how the connection between commodity price impacts and inflation has changed over the years. It highlights the importance of commodities with a strong energy focus in affecting inflation.

While the relationship between commodity prices and inflation has changed, it’s still important to understand. Knowing about these links helps in dealing with today’s economic challenges.

Investing in commodities is a smart move for many reasons. It helps protect your money from inflation and makes your investments more varied. Knowing how to approach this type of investing is key for many investors.

One big reason to invest in commodities is how they can help when prices are rising. Typically, the prices of commodities go up when things cost more for consumers. In 2023, commodities only increased by 0.8%, which was much less than the 12.1% spike in 2021. This shows that investing in these goods can guard your buying power when inflation is high.

Investing in commodities also makes your investment mix more varied. These items often don’t move in step with stocks or bonds. For instance, from 2011 to 2020, a key index for commodities had negative annual changes in 70% of the years. This kind of performance can help lower the total risk in your investment plan, making it more steady.

| Year | Commodity Price Change (%) | Inflation Rate (%) |

|---|---|---|

| 2021 | 12.1 | 9.1 |

| 2022 | 4.8 | 3.2 |

| 2023 | 0.8 | 3.2 |

| 2024 (Feb) | 0.3 | 3.2 |

Commodity investing can bring big rewards. But there are big risks too. The markets can change a lot, making prices go up and down. This can happen because of things like inflation, bad weather, and political problems. People might also try to make quick money by guessing these price changes.

There are also rules and political issues to think about. The decisions governments make can suddenly change the market. Big firms try to protect themselves by using things like futures trading. This is all done to handle the ups and downs better.

Prices in the commodity world can change quickly for many reasons. Oil prices, for example, can jump due to conflicts in important areas. Foods like corn and wheat’s prices can be hit by the weather, impacting how much farmers can grow. Metals like gold can change value based on how much factories are producing and the overall economy.

The laws and political decisions about commodities can have a big effect. For example, former U.S. President Donald Trump’s tariffs made steel and aluminium in the U.S. more expensive in 2018. Then China’s tariffs on U.S. farm goods in 2019 made those goods cheaper in the U.S. These moves show how much government decisions can shake the market.

To do well in commodity investing, you should know about these risks. Research and planning are key. Make sure you deal with regulated people and exchanges. This can help you avoid some of the big market swings and rules issues.

Commodity prices will depend heavily on energy market trends and sustainability efforts. These shape how much of a product is available, how many people want it, and its cost. Such influences are key in setting the future of commodity prices.

In 2024, energy prices are set to dip by nearly 5%. They will remain steady in 2025. This includes changes in oil prices, with Brent crude estimated to drop from $84 to $81 per barrel. Natural gas will see a 4% decrease in Europe and a 20% drop in the U.S. in 2024. The energy market trends of today will be important for tomorrow’s commodity prices.

Technological advances and sustainability are key players in deciding future commodity prices. The push for electric vehicles and their batteries is increasing the need for minerals like lithium and nickel. As electric vehicles become more common, the need for these minerals grows. However, there may be a shortage by 2030. Despite this, investments in fossil fuels have halved since 2013, with a significant increase to $700 billion in clean energy in 2021. Nonetheless, this is still far from the $2 trillion required in 2022. These changes highlight the vital role of sustainability in the future cost of commodities.

| Year | Energy Price Change | Metal Price Change | Agricultural Price Change |

|---|---|---|---|

| 2023 | -24% | -2% | -2% |

| 2024 | -5% | -5% | -2% |

| 2025 | Stable | 6% | -2% |

Key trends and new technologies point towards commodity prices rising. This balancing act between scarcity and innovation is critical in determining costs.

Supply chain management is key to keeping commodity prices steady. It ensures everything from sourcing to delivery goes smoothly. But, things like geopolitical conflicts or natural disasters can throw a spanner in the works, causing prices to swing wildly.

Having good strategies in place helps lower these risks. These methods include solid planning and using technology to predict price changes. A recent survey by Aon found that being able to guess future prices is more important than ever with risks related to commodity costs quickly moving up the chart. They expect these risks to be the third most serious by 2026.

Look at the Ukraine conflict: prices for wheat, palm oil, and fertiliser shot up. This shortage caused a big drop in crops. The demand for lithium, a key ingredient in batteries, also outpaced its supply. It meant car makers struggled to keep up. These cases show why it’s vital to manage supply chains effectively.

Then, there’s oil. Prices hit a 10-month high in September 2023. This was due to less oil from the U.S. and cuts in production from Saudi Arabia and Russia. It shows how important oil is for many sectors like making goods, moving things around, and packaging. It’s yet another reason why supply chain management is crucial, needing careful planning to avoid big price jumps.

| Commodity | Event | Impact |

|---|---|---|

| Oil | Reduced US shale production, Saudi & Russian output cuts | 10-month high prices, broad industrial impact |

| Lithium | Supply shortage 2022 | Spiked prices, affected car manufacturing |

| Wheat, Palm Oil, Fertiliser | Ukraine conflict | 30% reduction in crop output during 2022-2023 |

The impact on consumers from changing commodity prices is direct and wide-ranging. Especially, the cost of living can be hit hard, particularly with items like food and energy. The price shifts can greatly alter how much we spend. For example, in 2023, overall commodity prices rose by just 0.8%. This shows how closely market trends and what we pay are connected.

Nearly 36% of the Consumer Price Index (CPI) is made up of commodity prices. This is from data by the U.S. Bureau of Labor Statistics. Energy makes up about 7% of this and food covers over 13%. When the price of food goes up, it really shows in what we pay. Think about how food costs went up by 2.2% in the year ending February 2024. This change makes our day-to-day expenses go up, affecting our cost of living.

Changes in commodity prices can really affect purchasing power. Food and fuel are two key areas where we feel these changes most. Consider when the price of oil went above $80 a barrel in March 2024. This made transportation and heating more expensive. So, we have less money for other things, lowering what we can buy with our money.

| Commodity | Percentage of CPI | Price Change (2023-2024) |

|---|---|---|

| Energy | 7% | -1% |

| Food | 13% | 2.2% |

Looking into how commodity prices affect us is key. It helps us see how various parts of our spending are connected. The impact is real on our budgets, from what we pay for at the grocery store to keeping our homes warm.

To understand how commodity prices change, we must look at many things. These include things like supply and demand, economic issues, and important world events. The link between the US dollar and commodity prices has changed in recent years because of the world pandemic. Now, both the US dollar and commodity prices can go up at the same time.

Between early 2021 and mid-2022, food prices around the world went up by about 30%. Oil prices rose by about 150%, and in some places, natural gas prices increased more than six times. This change could mean the market is headed in a new direction. As the US went from importing oil to exporting, it changed how it did business with the world and its commodities, forming a new positive link with its strong dollar.

Importantly, the connection between money exchange rates and commodity prices is powerful, especially for countries that export a lot. These countries’ trading conditions can change a lot with just a small move in commodity prices. For places that mainly export raw materials, this change can deeply affect their economy. Research by experts shows that when export prices jump due to commodity shocks, it can greatly change a country’s GDP and economic growth.

So, keeping an eye on the various factors that affect commodity markets is key. Understanding the links between prices, exchange rates, and global health is crucial. This shows us how important planning and spreading risks are. In the future, everyone from investors to decision-makers needs to be aware and ready for these changes. This is how we can achieve strong, steady growth in our economies.

Improved global economy and low commodity supply boost prices. This change has caused prices to rise in energy, food, and metals. It has also stopped the prices from going down in 2023.

Commodity prices strongly link to economic signs, like the Consumer Price Index (CPI). Energy makes up about 7% and food over 13% of the CPI. If commodity prices go up, the cost of stuff we buy goes up, causing inflation.

Commodity markets help trade raw materials like food, energy, and metals. They use exchanges to sell futures contracts. This lets investors protect against price changes or bet on future prices.

Price changes in commodities matter for inflation, what we spend, and how stable the economy is. Since so many areas use these raw materials, their prices affect the cost of living and doing business. This makes them key economic signs.

How much people want and need of something, and how much is available, affects its price. This includes how much we produce and use things. This back and forth sets how much we pay for commodities.

Things like how much our country makes (GDP) and how many people have jobs tell us how well off we are. They also shape how much we use commodities and invest in them. This can really change commodity prices.

Many things, like seasonal demand or cutting production, can shake up prices. Big changes can happen from world decisions, like OPEC+ setting oil production limits. Even conflicts can affect what we pay for food, for example.

Global trade forms commodity prices as world events and deals play a big part. For instance, the war in Russia and Ukraine affects the amount we pay for grains. Decisions by OPEC+ can also change global oil prices.

Changes in energy prices, especially oil, show how well the world economy is doing. These prices matter because they can make things cost more. This in turn affects the choices governments and people make.

Weather and climate really affect how much we can grow and what we can get. For food prices and supplies, this is super important. But, tech in farming can help lessen the risks and trade changes.

Metals for industry and precious metals have big demand from tech and manufacturing. People also buy them to protect against rising prices. Metals like gold and ones needed for batteries are really influenced by this.

When commodity prices go up, so do costs for us on the everyday items. This feeds into inflation. Energy and food especially affect this big number we use to check how prices are changing.

Investing in commodities can help guard against inflation and add variety to a portfolio. They move in different ways than stocks and bonds, which can make a portfolio more stable and possibly grow more.

Commodities can change in price a lot and quickly. This can be risky for investors. Also, government laws and how countries do business with each other can suddenly shake things up in this market.

The future of commodity prices is being shaped by how we use and make energy. This includes more green energy and new technology. It’s also about making sure we use and make things in a way that’s good for our planet.

Keeping a clear supply chain stops big jumps in prices. When chain parts break, like during world problems or natural disasters, prices can swing a lot. Having strong plans in place is really important.

Prices of raw materials can change what we end up paying for things and how much we buy. Big changes in energy or food prices can really shake up our budgets and spending habits.