Menu

Did you know the farming industry faces a big challenge this year? It’s looking at a 24% less cash coming in. This is the biggest drop in the last ten years. It shows how volatile crop prices can be, making it hard for farmers to predict what they’ll earn.

Many things are causing this trouble. Tragic weather hits due to climate change are messing up when crops grow. And, fights between countries and disagreements on trade make prices jump around too much. This means the usual ways of setting crop prices aren’t working well. With so much changing, farmers and others are unsure how to protect their money.

Based on USDA facts, the farming industry’s pocket of money is 17% smaller than last year’s. And the sale prices of main crops like corn, soybeans, and wheat are set to fall by 5%, 11%, and 15%. Imagine being a corn farmer; last year, you could earn $242.33 per acre. This year, you might lose $65.75 per acre. It’s a massive change that hits the wallet hard.

With things this tough, good market information is a must. Fastmarkets is one source that gives up-to-date data on what’s happening. Having the right information helps everyone involved in farming make better decisions.

Geopolitical tensions put heavy pressure on crop prices worldwide. Our world is so closely tied that local fights and global relations hit food security and trade. The recent tensions between Russia and Ukraine show how fragile our food systems are.

Trade fights and tariffs make crop prices jump up and down. The US-China trade war changed the prices of farm goods a lot. Policies and licensing rules also make it harder to trade, adding to supply chain problems.

In 2022’s crisis, we saw 67 new trade moves, including 38 export bans. This caused the cost of food to sharply rise, going from 11% to 12.7% in just a few months.

Global supply chains are complex and easily affected by shocks. After the Russian-Ukraine conflict, export bans and rules spiked crop prices. The roles of Russia and Ukraine in the wheat, barley, and oil trade show how easily supply chains can break.

To fight the price rises, some tried fuel subsidies and other aids. This shows how geopolitical tensions hit and the moves made to fight back.

| Year | Food Price Inflation Rate | Key Geopolitical Event |

|---|---|---|

| 2020 | 2.2% | COVID-19 Pandemic |

| 2021 | From 5.6% (Jan) to 23% (Sep) | Russian Invasion of Ukraine |

| 2022 | From 11% (Dec 2021) to 12.7% (Feb) | Implementation of Export Bans |

Weather has a big effect on the cost of farm produce. Now, with climate change, these effects are more noticeable. In 2024, the farm sector saw big changes because of these issues.

Climate change is changing farming. In the U.S. Southern Plains, weather got worse. For example, the quality of wheat in Kansas dropped. The area facing drought went up too.

In Russia, dryness and frost hurt their wheat. This made experts lower their wheat production estimate by 5.0 MMT. This cut is part of a global pattern of crops suffering due to climate change.

Weather changing throughout the year also affects farming a lot. In April-May 2024, the wheat price in Chicago jumped. This rise was the biggest in nearly a year. It was because of unexpected weather changes.

The USDA also predicted Russia’s wheat yield would drop by 3.5 MMT. This would be for the 2024/25 season. Such changes in weather can make food prices go up. It shows why we need to prepare for these swings.

| Region | Condition | Impact | Price Projection |

|---|---|---|---|

| U.S. Southern Plains | Drought | Decreased wheat quality | Potential price elevation |

| Russia | Dryness & Frosts | Lowered wheat production | Increased market prices |

| Global | Seasonal variability | Unpredictable yields | Fluctuating commodity prices |

The key is to adapt to changing weather, fight climate change, and be ready for seasonal swings. This can help keep food prices steady.

To understand current crop prices, we need to look at many factors. These include world events, changing weather, and trade between countries. U.S. crop prices are likely to drop in the next three years before they level off. This matches what experts think will happen due to issues at home and around the world.

The amount of land used to grow crops also helps us predict changes. For example, the area for corn is expected to grow first, then fall. It might hit 92.0 million acres in 2023/24 but drop to 89.0 million acres by 2032/33. Soybeans, on the other hand, might see a small decrease in space from 87.0 million acres to 86.5 million acres. Wheat planting areas could go up by 1.8 million acres to 47.5 million acres by 2023/24.

These changes in planting space will affect how much corn, soybeans, and wheat we get. Experts predict we’ll get more corn per acre over time, reaching up to 200 bushels by 2032/33. Soybeans and wheat are also expected to do better, with 56.5 bushels per acre for soybeans and 52.7 bushels per acre for wheat. This could mean getting more than 16 billion bushels of corn and nearly 5 billion bushels of soybeans by 2032/33.

Looking at the bigger picture, trade with other countries is a huge factor. Corn sales could go up by about 20 percent by 2032/33. The value of soybeans that get turned into other products could increase from 2.3 billion bushels to 2.5 billion bushels. Expect an increase in the sale of beef, chicken, and pork over the next ten years. This will affect how much these foods cost and what farmers can expect to earn.

Also, we must think about meat when talking about crop prices. Beef and chicken will probably stay expensive. However, hog prices might go down. The number of cows in the U.S. is at its lowest since 1951. This can mean less meat available and higher prices for some.

| Crop | 2023/24 Acreage (Projected) | 2032/33 Acreage (Projected) | Yield (Bushels per Acre by 2032/33) | Production (Billion Bushels by 2032/33) |

|---|---|---|---|---|

| Corn | 92.0 million | 89.0 million | ~200 | 16.18 |

| Soybeans | 87.0 million | 86.5 million | 56.5 | 4.84 |

| Wheat | 47.5 million | N/A | 52.7 | N/A |

To wrap up, the farming industry must keep up with changes to do well. By watching trends and expert advice, they can plan for better current crop prices and future needs.

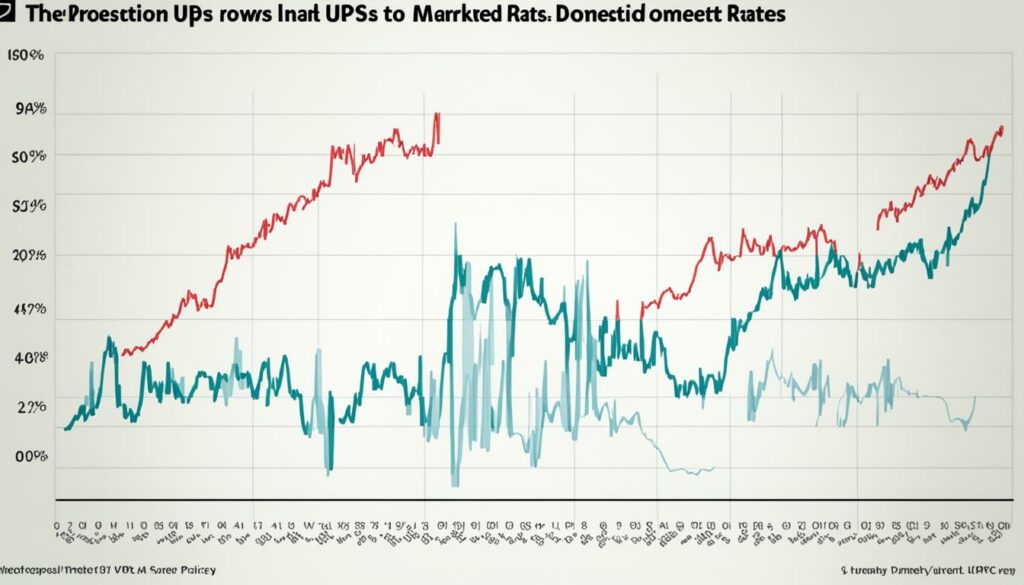

Domestic policies are key in setting market rates for farm products. These policies include things like subsidies, support for farmers, and environmental rules. They are big factors in how much farm goods cost. Knowing about these helps those working in agriculture understand the market better.

Subsidies and support help keep market rates steady and aid farmers. For example, subsidies ease the cost of making farm goods. This keeps farmers competitive. Government support can also change how much we grow and the price of crops. From 1993 to 2023, U.S. farmers grew between 219 to 242 million acres of crops each year. This shows how important support is in keeping production steady.

Rules about the environment also shape agriculture’s market rates. These rules work to make farming more sustainable. But they can add to how much it costs to farm, which affects prices. Tough rules may mean farmers need to spend more, so products cost more. Yet, other countries with fewer rules might have lower costs. This can change prices globally.

The following table presents a comparative analysis of various agricultural metrics impacted by domestic policies:

| Metric | Value | Impact |

|---|---|---|

| California Crop Value (2017) | $33 billion | 59% higher than Illinois |

| Annual Planting Acreage (1993-2023) | 219-242 million acres | Consistent support programs |

| Milk Output Increase (1980-2019) | 70% | Exceeds 218 billion pounds |

| Raw Cotton Exports (1990s vs Now) | From | Effective export policies |

Government policies, like subsidies, support, and green rules, have a big impact on prices. They help keep rates stable and the farming sector healthy.

The biofuel industry is growing fast. This growth changes how much food crops cost. Biofuels like ethanol and biodiesel make the prices of crops used to make them go up. Knowing this is key for farmers and others in farming.

More than 40% of U.S. corn goes to make ethanol. This use has increased 650 times since 1982. The big demand has caused corn prices to soar. From June 2006 to June 2008, U.S. biofuel needs made corn prices jump by 22%. Laws like the Renewable Fuel Standard connect directly to this. For each extra billion gallons of ethanol, corn prices go up by 2 to 3%.

Biodiesel making also impacts crop prices, especially soybeans. Policies for biofuels made soybean prices go up by 20%. Worldwide, making more biofuels has raised prices for many foods. From corn to soybeans to sugar, prices rose a lot over two years until June 2008. This increase shows the higher demand for biofuels.

Even though biofuel rules raise prices by 30 to 45% in the case of corn since 2015, other things matter too. Over 90% of the world’s higher food prices are due to factors not linked to biofuels. This shows how complicated food prices can be.

| Factor | Impact on Corn Prices |

|---|---|

| Biofuel Demand | 30-45% increase since 2015 |

| Renewable Fuel Standard | 2-3% rise for every billion gallons |

| Global Biofuels Production (past 2 years) | 27% rise |

| U.S. Biofuels Production Increase | 22% rise |

| EU Biofuels Production Increase | Approx. 3% increase |

Changes in global trade greatly affect crop prices. The World Bank’s index reached 133.8 in May 2022. This was up by 60.5% in two years, showing how trade impacts crop prices.

Food insecurity is a big issue. About 193 million people in 53 places have crisis-level food scarcity. The pandemic worsened things, pushing a global stock ratio above safe levels. This shows how trade problems can affect food markets.

During the pandemic, export limits were put by countries like Vietnam and India. This, plus high crude oil prices, raised food costs globally. So, other factors aside from trade also touch on crop prices.

The US’s policies during the pandemic also affected food prices. Their actions and trade flows are closely linked. This relationship shapes the agricultural market.

Now, climate change, demand from emerging nations, and natural disasters add more uncertainty. Studies suggest a detailed look is needed, possibly using new technology like machine learning.

Global corn production might drop due to key areas having smaller harvests. Yet, wheat production worldwide could rise by 10.5 million tons. Such forecasts are important to understand trade impact on crop prices.

Geo-trade patterns are changing. Egypt might become a top wheat importer, whilst Indonesia and Pakistan could import less due to growing locally.

| Commodity | Import Growth (year-over-year) |

|---|---|

| Agricultural Products | 36.8% |

| Energy-related Products | 74.1% |

| Minerals and Metals | 28.3% |

In summary, global trade flow shifts are key to crop prices. They largely affect the agricultural market.

Technology has changed the way we do farming. It has boosted crop yields and shaped how we sell farm products. By mixing advanced tech with old farming ways, we’ve made farming more effective and kinder to the planet.

Precision farming uses technology to track and improve how we farm. It lets farmers make choices based on data. This improves how much we grow and how we use resources. Since 2001, the use of gadgets like yield monitors and guidance systems has grown. These tools help farmers use water, fertilisers, and pesticides better.

Genetic modifications have also changed farming. Nowadays, 91% of corn fields in the U.S. use these special seeds. They make crops stronger against bugs, diseases, and hard weather. This means we can grow more corn now than in 1996.

Data analytics is a big help in farming today. It uses data from space, sensors, and smart devices to improve farms. It can help farmers use fewer resources and get more crops. For example, looking at nutrient data has made farming more productive and cheaper.

The table below highlights some key statistics that underline the impact of technological advancements on agriculture:

| Metric | 1996 | 2016 |

|---|---|---|

| Average corn yield (bushels/acre) | 130 | 183 |

| Percentage of corn acres with genetically engineered seeds | — | 91% |

| Average operating costs per acre | $161 | $341 |

| Percentage increase in seeding rates | — | 15% |

It’s crucial to remember how technology has changed farming. By using precision farming, genetic changes, and data analytics, we can farm better. These ways are not just good for the planet but also bring big benefits for farmers and customers.

Knowing about market-reflective price data is key for people in farming. It gives deep insights into supply and demand trends. This is crucial for those who need accurate info about the agricultural market.

Let’s look at June 2022’s data. The Prices Received Index was 134.8, a slight increase by 0.2% from May and a big jump of 26% from June 2021. The Crop Production Index rose to 125.6, 2.2% higher than May, and a good 17% above the last year.

The Livestock Production Index hit 144.9. It was 0.8% lower than May but a strong 35% above last year. This shows how crucial it is to have the latest tools for financial risk management that use strong data.

In June 2022, the Prices Paid Index also went up by 0.4% from May and 13% from the year before. The Prices Received to Prices Paid ratio was balanced at 100%. This shows an almost even economic situation for that time.

Fastmarkets is great at sharing detailed market data. It helps to track current trends and predicts future market moves.

Looking at commodities such as oranges, corn, hogs, and soybeans in June 2022, prices went up. However, strawberries, broilers, milk, and wheat saw their prices drop. This shows the need for careful monitoring by those in the market.

In April 2024, the FAO Food Price Index went up by 0.3 from March, but it was 7.4% less than a year ago. The FAO Cereal Price and Vegetable Oil Price Indexes also rose a bit. But, global wheat export prices steadied and maize prices went up because of high demand and issues with getting supplies.

Market-reflective data gives important details for managing financial risks well. For those in the farming world, using this data can help plan ahead instead of just reacting to changes.

In agriculture, managing financial risks is key for farms to keep running well. This is because crop prices can change a lot. To deal with this, farmers use strong strategies like hedging and good insurance. These help them avoid big losses from price drops.

Hedging is very important in dealing with the up and down of crop prices. For example, a farmer might sell future corn to protect against a fall in corn prices. The risks of hedging include local price changes and the value of futures. To protect their finances, some farmers or processors do the opposite in cash and futures markets, this keeps them safe.

In hedging, what you get in the end depends on the futures price and other costs. According to history, the difference between local cash and futures prices usually gets smaller as the year goes on. Knowing these trends is crucial for managing crop prices well.

Insurance is also very important for a stable farm finance. It protects farmers from losses due to bad weather or other sudden problems. With the right insurance, farmers can feel secure and make better plans for their farms. This helps them invest in the future with more confidence.

By using both hedging and insurance, farms become more stable. This combo helps farmers face the ups and downs of the market. It keeps their financial risks low, improves their management of crop prices, and secures their business’s future.

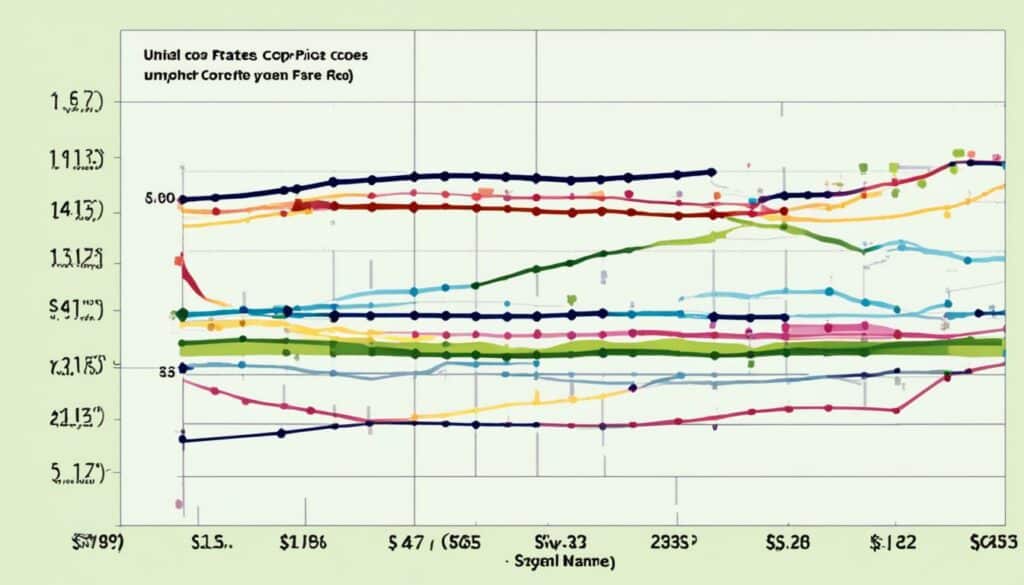

Looking into the United States crop market rates gives us a deep look at farming today. Corn, wheat, soybeans, and upland cotton covered an average of 236 million acres from 2014 to 2023. This shows how vital it is to watch how the market changes, especially for corn and soybeans.

We must keep an eye on the corn and soybean market trends as they are key to the U.S. farm economy. The USDA says the prices of these crops have been falling. This is mainly due to higher costs and changes in trade. Also, unpredictable weather makes it hard to predict how much corn and soybeans we can grow.

Wheat and cotton prices show fascinating patterns too. In April and May 2024, the wheat futures at the Chicago Board of Trade rose from $5.53 to $6.87 per bushel. This big jump highlights how prices can change a lot. On the other hand, nearly 85 percent of U.S. cotton is now sold overseas. This shows the global market’s big role in setting our prices.

The study of crop market rates in the U.S. points out how complex this area is. We need to think about costs, the weather, and what other countries want. This is to truly understand the market for corn, soybeans, wheat, and cotton.

In 2023, global commodity trading prices changed a lot due to many reasons. The World Bank’s index for commodity prices fell by almost 24 percent. This had a big impact on the market all year long.

Oil prices went up and down a lot, especially because of trouble in the Middle East. They started at $72 and ended the third quarter at over $90. Then, they settled at $83 by November. Experts think oil will average $84 a barrel in 2023. This is less than the $100 it cost in 2022.

Energy markets look to go down by around 5 percent in 2024 but should stay steady in 2025. On the other hand, natural gas in Europe might drop by 4 percent. The United States could see even bigger price drops, with LNG prices expected to fall by 7 percent in 2024.

Agricultural commodity trends are generally going down. Prices for farm goods dropped by 2 percent in Q3 2023. They are expected to fall by another 2 percent each in 2024 and 2025. Food prices had gone up by 2.2 percent in the previous year.

Metal prices fell by 2 percent in Q3 2023. But, they are expected to be stable in 2024 and then rise by 6 percent in 2025. The need for minerals, like those used in electric cars and batteries, is growing. This is why metal prices are expected to increase.

In 2023, commodity prices only went up by 0.8 percent. This is much less than the big rises of 2021 and 2022. Gold, for example, went from its highest at $2,057 per ounce in May 2023 to $1,831 per ounce in October. Then, it climbed back up to nearly $2,200 per ounce by March 2024.

Here’s a table showing important commodity prices through the year.

| Commodity | Q3 2023 Prices | Projected 2024 Prices |

|---|---|---|

| Oil (per barrel) | $83 | $84 |

| Natural Gas (Europe) | $70-$80 | -4% |

| Agriculture | -2% | -2% |

| Metals | -2% | 6% |

| Gold (per ounce) | $1,831 | $2,200 |

It’s very important to understand global commodity trading prices. This knowledge helps in making smart moves in the farm markets. By looking at the 2023 market rates and trends, people can choose the best path forward.

Looking at the costs and revenue in farming is crucial now. The U.S. has seen a 7% drop in farms since 2017. Farm sizes are growing, now at an average of 464 acres. This means farming finances must be managed even more wisely.

Fertilizer costs are changing a lot. Luckily, they might drop by 17% from 2023 to 2024. Planning seed expenses is also key. It will cost $613 to plant one acre of soybeans in 2024. This is a 1.4% drop from last year. These price drops help with financial planning.

Farmers face big challenges with operational costs. It’s predicted these costs will go up by 3.8% to $455.1 billion in 2024. Some costs, like interest per acre, are expected to drop by about 30%. Land costs might fall by 1.4%. Despite this, the overall costs are still rising. This difficult situation means farmers have to change their plans, especially due to higher costs of producing corn and soybeans.

| Year | Input Cost Per Acre | Change from Previous Year |

|---|---|---|

| 2023 | Corn: $888, Soybeans: $622 | |

| 2024 | Corn: $856, Soybeans: $613 | Decrease (Corn: 3.6%, Soybeans: 1.4%) |

Analysing fertiliser and seed costs is complex. It shows how important it is to plan well financially and strategically. Understanding these parts of farming helps farmers deal with their costs better and aim for more financial stability.

Learning about agricultural economics and the latest farming prices requires insights from top industry analysts. Their views are crucial. They help everyone involved make better plans.

Analysts note a hike in ethanol corn use by 25 million bushels, reaching 5.4 billion. Corn’s season-average price is now estimated at $4.70 per bushel. This figure is a bit lower than before. Soybean prices have dropped 10 cents from March, now at $12.55 per bushel. Wheat prices have also slightly slipped, now at $7.10 per bushel.

In the U.S., the cattle herd is the smallest it’s been since 1951 at the start of 2024. Despite this, beef production is growing, mainly due to more exports expected. Pork production numbers are also up, hinting at an almost 8% boost in U.S. exports for 2024. These insights underscore the influence of expert views on farm prices.

Seasonal forecasts are key for farmers and others in agriculture. The economy showed a 3.3% growth last quarter of 2023, but the goal is to reduce inflation to 2%. These big economic moves will likely affect the farming market a lot.

In January, 353,000 new jobs were added, beating expectations. This signals a lively economy but also shows the market is volatile as corn prices went below $4 per bushel and soybeans are at their lowest since November 2020. The long view shows average prices for corn and soybeans dropped a lot between 2012/13 and 2014/15.

Knowing these forecasts helps people in agriculture understand the market better. Below is a table with some important price projections:

| Commodity | Current Price | Previous Month’s Estimate | Future Projections |

|---|---|---|---|

| Corn | $4.70/bushel | $4.75/bushel | $4.00/bushel |

| Soybean | $12.55/bushel | $12.65/bushel | $12.00/bushel |

| Wheat | $7.10/bushel | $7.15/bushel | $6.50/bushel |

Finally, expert opinions and seasonal projections are vital for interpreting market changes. The detailed data aids in making wise decisions.

The agricultural market’s complex nature makes having strong price volatility strategies critical. Wheat prices jumped over $2 in a single month. Corn and beans, however, have calmed after a period of high growth. On May 18, many farmers faced losses between 20 to 50 cents per bushel across these markets. This shows how uncertain agricultural prices can be.

Farmers face tough choices when selling, even if prices are high or low. Let’s look at the figures for crops like corn and beans set at $7.40 a bushel and $15 a bushel for 2022. If a producer spends $1,050 per acre on corn and sells it for $7.32 a bushel, they could make about $450 profit per acre. This shows how important it is to watch market trends closely to make money.

But, trading futures or options always carries a big risk of loss. What was successful before might not work in the future. So, it’s extremely important for producers to manage risk well and keep up-to-date with information. This is key to staying stable in the face of market ups and downs.

Geopolitical tensions can mess up global supply chains. They change trade balances and add costs. This leads to market uncertainty and affects crop prices.

Climate change causes weird weather, harming crop yields. This leads to unstable prices for agricultural produce. There’s a lot of uncertainty in the market.

Seasonal weather changes influence when crops can be planted and harvested. This affects the supply and quality of produce. It changes the prices we pay for food.

Today’s crop prices depend on many things – events, weather, and demand. Good planning and keeping an eye on trends can help in predicting prices.

Subsidies and support programmes from the government affect how much we pay for food. They can make prices stay the same or change a lot. This is because they affect the costs for farmers.

The need for biofuels makes crop prices go up. For example, crops like corn and soybean can become more expensive. This is because they’re used to make biofuels.

Global trade changes can shake up crop prices. Trade deals, taxes, and tensions move crops around the world differently. This can change how much they cost.

New tech can make farming better. It boosts crop yields and saves resources. Since it makes farming more efficient, it can also lower the prices we pay for food.

True price data helps everyone make smarter choices. It’s key for understanding the market and avoiding risks. This keeps the market competitive and stable.

Farmers can protect themselves with smart strategies. Hedging and insurance help shield against price ups and downs. They keep farmers’ income steady.

Right now, the US crop market rates are going down. Key crops like corn, soybean, and wheat are affected. This is due to economic issues and higher production costs.

Next year’s crop prices are influenced by many things. These include how much is grown, global tensions, the weather, and trade rules. Knowing these factors helps mark success in the market.

Higher costs for things like seeds and fertilisers make farming less profitable. This strains farmers’ budgets and makes it hard to stay in business. It’s tough to keep profits high.

Experts’ views explain what’s happening now and what might happen next. They give clear advice to those in farming. This helps make wise decisions based on facts.

To handle changing prices, it’s vital to stay well-informed and use risk tools. Being ready and proactive can protect against money loss. It also helps in keeping the market steady.