Menu

Did you know that when commodity prices are affected by interest rate changes, some countries see their GDP go up to twice the usual rate? This fact shows how closely linked export goods’ prices are with how well countries’ economies are doing. I’ve looked into this and found out that what the US does with its money and how the world’s economy is doing are key factors. They really influence how well these countries do economically.

Studies by Davies et al. and Miranda-Agrippino and Rey showed something interesting. They found that when commodity prices change on their own, it makes the US’s money decisions affect these countries even more. The connection between what these countries sell overseas, how much money they make, and the changing market rates shows us how their economies are both fragile and important. Knowing all this helps us understand how world trade and economies depend on each other.

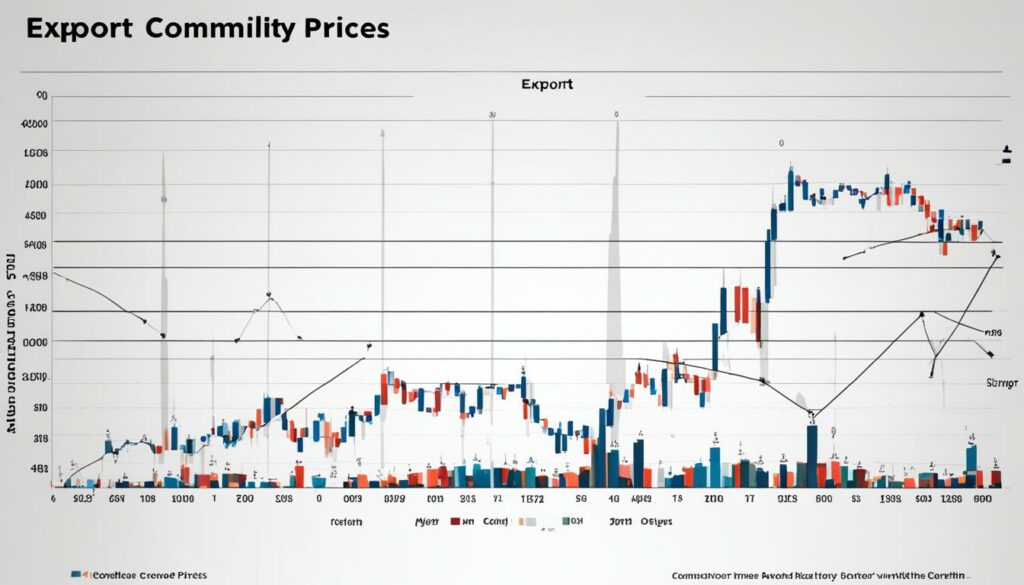

It’s crucial to know about export commodity prices for international trade. They impact the costs of imports and exports worldwide. Commodity prices are key for global trade and economy, especially in places that rely on selling primary goods.

Commodity prices hugely affect global trade by changing import and export costs. For instance, from early 2021 to mid-2022, food prices went up by 30%. Oil prices increased by 150%. In some places, natural gas prices went up over six times. Such changes highlight the need for detailed import cost checks. Trading prices rise when commodity prices rise, making transactions across borders more costly.

Many things affect export commodity prices and thus international trade dynamics. Knowing these factors is important for correct import cost analysis. Key influences are:

Knowing about these factors helps in understanding international trade’s complexities. It also shows how critical commodity prices are for economic health and global transactions.

Understanding how US monetary policy affects export prices gives us key insights. It shows how the global financial cycle and commodity pricing are linked. Studies prove that US monetary policy changes hugely affect world markets. And this, in turn, messes with export prices.

When export prices change, it often follows the global financial cycle. Big boosts due to sudden high commodity prices can help a country’s economy. US monetary policy and how much risk the world is willing to take are big drivers. These changes move through many economies, especially those that depend on selling commodities.

Some countries really feel the highs and lows of commodity prices – even more so than others. They can see their economy grow double compared to the average. This happens when interest rates affect these commodity prices. For instance, in Emerging Markets and Developing Economies (EMDEs), big changes in commodity prices can shake up export prices and economy. Changes in US policies or global risks can affect this a lot. This can lead to better or worse times for these regions.

Big jumps in export prices from shocks in commodities or the global financial cycle can mean great growth for EMDEs. However, less is felt from worldwide risk changes. Countries that sell commodities and are really price-sensitive are most at risk. This is why these countries need to carefully plan how they price what they sell.

To protect EMDEs from big external finance shocks, policies that help them sell more kinds of things are needed. This is very important, especially for places that mostly sell basic goods. It helps keep their export prices steady against up and down global finance trends.

In today’s world, global financial conditions greatly impact export prices. Many things, from interest rates to how willing people are to take risks, play a part. They show how markets change prices and affect economies. These changes not only impact prices; they also show how healthy a country’s economy is.

Interest rates are key in setting costs for holding products. They also change the wants of people to buy different things. Looking at how export prices relate to a country’s economy, we see big impacts when interest rates change. Some countries that sell a lot of goods because of these rate changes seem stronger economically, by up to twice the usual amount.

How much risk the world is willing to take affects prices too. When prices get reviewed along with how risky people think some loans will be, we see a year later that money moves around a lot. Also, when the price of selling goods goes way up because of sudden big demands or world financial trends, it boosts that country’s economy.

The endogenous response of commodity prices to global shocks is crucial in the transmission of US monetary policy to EMDEs, underlining the importance of maintaining financial stability amidst fluctuating global conditions.

Last year, buying prices for trading goods in the US shot up by 36.8%. Regular non-trading goods went up by 16.6%. It was the same for selling: trading goods saw a 35.1% jump. This shows how the world’s buying trends deeply affect prices. It highlights how linked the world’s financial conditions are to what things cost in trade, mainly when the economy is very active.

| Year | Commodity Import Increase (%) | Non-Commodity Import Increase (%) | Commodity Export Increase (%) | Non-Commodity Export Increase (%) |

|---|---|---|---|---|

| 2020 | 15.4 | 10.3 | 18.7 | 12.1 |

| 2021 | 36.8 | 16.6 | 35.1 | 17.1 |

In the end, many things can change prices, but big global financial trends, interest rates, and risk levels are among the most important. Knowing about these is key for those in charge and anyone involved in selling abroad to handle the challenges that come with these global trends.

When setting export prices, it’s crucial to know all the costs involved. Things like tariffs, customs fees, and currency changes can make the final price higher. This means the price an importer pays can be a lot more than what it’d be in the United States.

When any business deals with sales across borders, they must think about many things to get the price right. This includes transport costs, duties, and even special development costs. The way goods move, for example, if they go Ex-warehouse, FOB, or Direct Import, can change the price too. So, understanding these supply chain considerations is key for making more from exporting.

Market demand and rivals are also key to deciding on prices. How much people earn per person shows market potential, and checking what others are charging is important. Responding to changes in the market, like supply and demand, and exchange rate changes, is a must. Being flexible helps with making more money and keeping export sales growing.

| Factors | Description |

|---|---|

| Transportation Costs | Shipping and logistics expenses that affect the final price. |

| Duties and Taxes | Various tariffs, customs fees, and value-added taxes. |

| Supply Chain Models | Ex-warehouse, FOB, Direct Import—all impact pricing differently. |

| Currencies Fluctuations | Changes in exchange rates can alter pricing significantly. |

| Market Demand | Demand elasticity and competitor pricing drive market rates. |

If you’re exporting, understanding these supply chain considerations can really help. It makes navigating cross-border transactions easier and can lead to more money from exports in the long run.

Knowing market dynamics is key in understanding how export prices are set. By looking at trends and other factors, we see the complex world of market prices. A study across 54 Developing Economies used special methods. These methods look at how events change GDP and export prices.

Studying how average export prices and the Baa spread change helps. It shows how the market and competition are linked. Some countries get bigger GDP changes when US policies change. This shows the need to understand market dynamics for better strategy.

Having good pricing strategies is crucial in the world market. Diversifying exports helps deal with market shocks, especially for countries with few products. Also, prices going up because of shocks help the economy grow. So, analysing the market helps make better pricing plans.

Understanding market dynamics helps in making smarter decisions. It keeps exports strong in a tough global market. Looking at costs in detail helps stay competitive and sustainable.

When setting export commodity prices, you’ll find two main strategies: top-down and bottom-up. Each has its good points and complexities, suited for different markets and competitors.

In the top-down strategy, you start with the desired market price. Then, take out the costs to find the right selling price. It’s useful in markets where your starting price should feel like its market value. For example, factors like retailer and distributor margins, along with VAT, affect the price. Retailer markups are normally between 25% and 45%, with distributors not far off. Getting these prices right is key to success.

On the flip side, bottom-up strategies focus on all costs. Then, a profit margin is added to set the sale price. This method ensures you cover your costs and make a specific profit. You need to think about things like import duties, money for marketing, and the costs for shipping & insurance. Import duties can really change the final price for customers. Knowing the ins and outs of shipping and insurance costs is crucial for setting a good price.

The table below shows a comparison of the two strategies in terms of export pricing:

| Pricing Approach | Description | Key Considerations |

|---|---|---|

| Top-Down Pricing | Market price set first, with costs removed to find the selling price | Retailer Margin, Distributor Margin, VAT |

| Bottom-Up Approaches | All costs are figured first, and then a margin is added for the price | Import Duties, Marketing Funds, Freight & Insurance Costs |

Both these pricing methods rely heavily on understanding the market and outmanoeuvring the competition for profit and relevance. Strategies like co-operative pricing, cutting prices, or ignoring pricing help set the final export prices. Knowing how to use top-down or bottom-up depending on the situation can really help businesses make the best decision for their export pricing.

Exchange rates going up and down really affect prices of goods we sell abroad. This can change how much we make or spend. It’s key for companies dealing worldwide to get how exchange rates and trading work together. This helps in making smart choices.

Picture a country selling more than it buys from other places. People want more of its stuff and its money, pushing its currency value up. But, if a country buys more than it sells, its money might not be as sought after, making its currency weaker. These shifts can really mess with exchange rates, changing how trade looks overall.

If exchange rates rise, a country’s products and services might become too expensive for others to buy. This could mean less money from sales and higher costs on things we buy from abroad. Companies need to look closely at import cost analysis to stay profitable.

Higher demand from other countries for what a nation makes can up its currency’s value. This is good news because it makes a country’s goods and services more attractive globally.

Studies show big impacts from exchange rate changes on what things cost, currency values, and trade balances. For example, we can guess what will happen to exchange rates for 11 countries that export goods based on their prices. We can guess right up to two months ahead. This guessing is much better with specific prices than using a random method. It shows how important it is to watch exchange rates when setting prices for what we sell abroad.

Surprisingly, it seems goods like commodities can directly change exchange rates. This is especially clear for countries heavily exporting these goods. Getting these links helps companies make better pricing plans, reducing risks linked to changing exchange rates.

Looking into how commodity price shocks affect domestic GDP growth shows us something key. Emerging Markets and Developing Economies (EMDEs) feel these changes deeply. The complex links between commodity prices and GDP are influenced by many factors. These include U.S. monetary policy and global risk appetite.

Studying commodity price shocks in 54 EMDEs reveals something interesting. It shows big changes in export prices and GDP from their usual trends. This highlights how open these economies are to outside factors. EMDEs that rely heavily on commodities often see larger GDP changes. These occur when interest rates affecting these markets change, showing they are more at risk.

Looking at how commodity price shocks move through the economy is revealing. Rising commodity prices can kickstart a need for more products worldwide. Low interest rates, however, can make holding onto these products cheaper, leading to higher prices. These combine to push export prices up. This then helps EMDEs see big leaps in their GDP.

A model helps explain how global conditions and commodity prices are linked. It shows how changes in U.S. monetary policy and market risk affect exports and GDP. For example, countries selling price-sensitive goods are hit hard by U.S. policies. This shows how complicated this relationship can be for EMDEs.

By looking at real data, we’ve learned a lot about how commodity prices affect EMDEs over time. Countries like Brazil, Chile, and South Africa show clear signs of following economic cycles closely. This happens through their GDP, inflation rates, and more, all reacting to these commodity price changes.

The study recommends that these countries diversify their exports to avoid shocks. Since many depend largely on selling raw materials, finding new things to export is crucial. This move can protect them from the ups and downs of commodity markets.

| Country | Real GDP per Capita | Annual CPI Inflation Rate | Real Broad Effective Exchange Rate | Unemployment Rate | Net Exports as % of GDP | Nominal Interest Rate (T-bills) | Trade-Weighted Commodity Price Index |

|---|---|---|---|---|---|---|---|

| Brazil | 5,120 | 6.7% | 102.3 | 8.5% | 1.2% | 7.5% | 150.2 |

| Chile | 14,030 | 3.2% | 98.7 | 6.2% | 3.0% | 5.2% | 140.6 |

| South Africa | 6,920 | 4.9% | 96.5 | 27.7% | -0.5% | 9.2% | 133.8 |

The world market is often unpredictable, which makes it hard for countries to keep their economies stable. To counter this, many places use a technique called export diversification. This means they sell more than just one type of product. It helps to lower the risk if the price of one product drops, as income comes from different sources.

Export diversification helps countries not rely too much on just one item for their income. This way, if the price for one item falls, they’re not as badly affected. For example, Chile has worked to use less money when prices are high so they can spend more when prices are low. This has made them better at dealing with sudden changes in the market.

In a similar way, Ghana has looked into ways to protect the price of their cocoa ahead of time. They do this by trading in what’s called the futures market. It’s like an insurance policy for when cocoa prices drop. These efforts show how trying new things can make dealing with price changes easier.

Having a mix of products to sell helps countries when the price of one item falls. This way, countries are not hit as hard by sudden changes in the market. They can keep their income more stable this way, even if some prices go up and down.

Using financial tools can also protect against price swings. For instance, Mexico has used certain contracts to make sure they don’t lose out if oil prices drop. These tools allow for a safety net if the market goes against them.

But, these tools are not always easy to get for protecting long term income from new resources. One suggestion is to tie the country’s debts to their product prices. This would mean when the price of what they sell falls, their debt payments also go down. It could be a good solution, although not many have tried it yet. Maybe organisations like the World Bank can help in finding better financial solutions for these situations.

Combining strategies like diversifying exports and using good financial tools can make a big difference for countries that rely a lot on what they sell. It makes their income safer and easier to predict. This means countries can plan better for their future, even if prices in the market change.

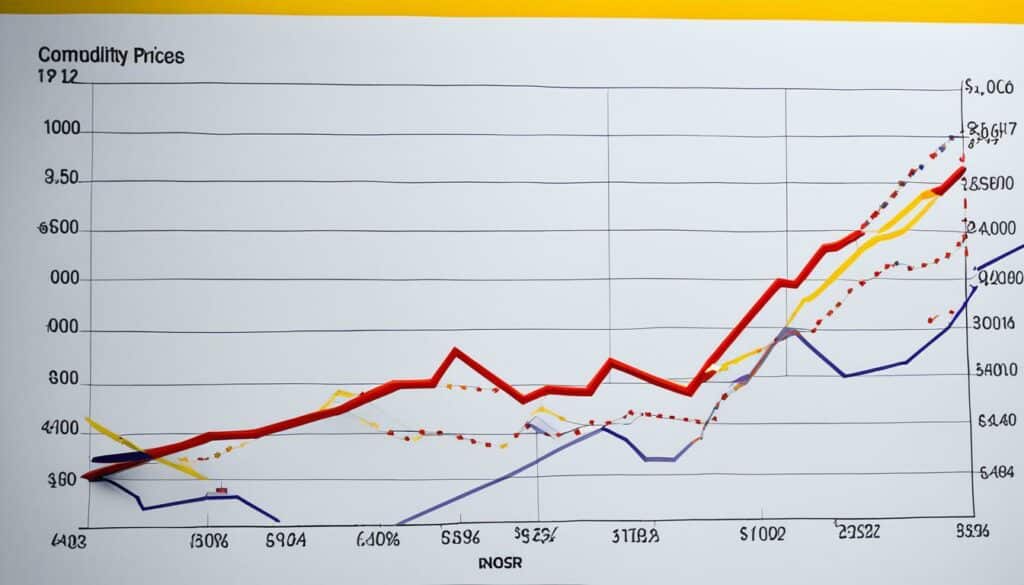

To understand export commodity prices, we must look at their history. This helps us see trends and guess what the future might hold. Looking at export prices (Px) and GDP deviations in 54 EMDEs, we learn about their economic actions.

Panel (b) shows export prices rising due to things like commodity price shocks. This often helps a country’s GDP grow. It’s more significant for places where the market changes with interest rates.

Changes in commodity prices can greatly affect the GDP of EMDEs. They can also feel the US monetary policy impacts. Countries selling price-sensitive exports face bigger risks. So, studying historical data on prices can be vital for economic planning.

The U.S. has a vast database on exports, including goods from many partners. This data is very helpful in understanding market trends and economic effects. With tools like U.S. FT900 and USA Trade Online, people can get specific data. Such detailed information aids in making smart economic and trade choices.

Technological advances have really changed how prices are set in the market. Now, with the help of advanced tools, companies can better predict what people want. This makes their pricing more accurate, leading to higher profits from exports.

Also, better logistics tech helps manage the whole supply chain better. It keeps costs lower and lets companies stay competitive. These tools also help deal with surprises, like bad weather or crises, without changing prices too much.

“With the advent of predictive analytics, companies are now better equipped to navigate the complexities of global markets, ensuring timely responses to demand surges and price fluctuations.” – Industry Expert, Jane Smith

Blockchain is another tech that’s making a big difference. It brings more openness and honesty to deals, which cuts down on cheating and makes sure prices are fair. This lets businesses do better in the market and earn more from their exports. Below is a table showing how these changes in tech have influenced trade over the past year.

| Category | 2020 | 2021 | Change (%) |

|---|---|---|---|

| Agricultural Products Imports | $163.4 billion | $193.8 billion | 18.6% |

| Energy-Related Products Imports | $125.9 billion | $219.2 billion | 74.1% |

| Forest Products Imports | $44.5 billion | $61.0 billion | 37.0% |

| Energy-Related Products Exports | $156.4 billion | $247.3 billion | 58.1% |

| Minerals and Metals Exports | $128.1 billion | $169.5 billion | 32.3% |

| Agricultural Products Exports | $157.5 billion | $185.7 billion | 17.9% |

Regulatory measures and policy decisions really change export prices. These rules affect how the market works and how well prices can compete worldwide.

International trade agreements are crucial for export prices. They aim to make trading easier by cutting tariffs and making markets more open for agricultural goods.

In 2017, certain agricultural goods saw their tariffs go up by a lot, from 2% to 140%. These big jumps show how much policies can shake up trading prices.

Also, between 2015 and 2021, over 900 Chinese companies wanted a special deal for importing wheat. 171 of these companies tried every year for seven years straight. This proves how important trade agreements are in controlling who gets to buy and sell goods.

Environment rules also greatly change export prices. These rules make it more expensive to export some goods, or sometimes even stop them being sold. For example, China refused food imports a lot in 2007 and 2017 because they didn’t meet their strict environmental rules.

A report from 2016 checked what Japanese buyers think about U.S. beef. It showed they value beef from places that follow green and safety rules. This proves the role of environmental rules in setting trading prices and policies.

Plus, research showed that from 2008 to 2010, food rules across 125 countries made a chain reaction. It made it more likely that new export limits for basic foods would happen. This worldwide impact caused a 1% jump in the price of food sold internationally.

The future suggests the global market will change in response to export prices. The World Bank thinks commodity prices will drop by 4 percent in 2024. This is due to lower energy and natural gas prices, particularly in Europe.

U.S. natural gas and LNG prices are expected to fall by 20 and 7 percent, making big changes for those who export them. After rising from $72 to over $90 by Q3 2023, Brent oil prices have been up and down.

| Period | Price ($/bbl) |

|---|---|

| Q3 2023 | Above $90 |

| November 2023 | $83 |

| Average 2023 | $84 |

| Average 2022 | $100 |

Agricultural prices fell by 2 percent in Q3 2023. They’re expected to change more, affecting export prices. Metal prices could drop in 2024 but rise by 6 percent in 2025, posing both challenges and opportunities.

Investment in clean energy is growing fast, up nearly 28 percent from 2021 to 2023. This move to cleaner energy will impact market strategies and policies, helping to steady commodity prices.

Food prices went down by 8 percent in 2023 and are expected to fall another 3 percent in 2024. This shows how important it is to predict export prices. Changes will affect many economies, requiring smart and flexible strategies.

Several factors will affect export prices, from geopolitical events to new technology and policies. Countries and businesses will need to be innovative and strategic in dealing with these changes.

The prices of things we sell abroad are affected by many things. These include how global money works, the state of markets, and new tech. A 2024 study looked at 54 places trying to grow their economies. It found that when the cost of what they sold went up, their economy did better. If a country’s main things are affected by interest rates and the prices change a lot, their economy might do twice as well as others. This shows how important it is for a country’s economy to get a good price when they sell things.

Other studies pointed to big, global money changes and changes in how much the world wants to take risks as reasons why money moved in and out of certain countries. Places that sold a lot of basic things that everyone needs were hit the hardest by these changes. By using a special method, these studies showed that bad changes in what these countries sold hurt their economies. This means these places need to sell more types of things to protect their economies better from these ups and downs.

Looking ahead, the worldwide mix of what things cost, new ways of making things, and how we trade will stay very important. The World Bank thinks what things cost will go down by 4% in 2024. This is part of a wider trend where prices might not change as much as before. For those in the business of selling things overseas, it’s key to really get these money trends and plan well. This way, we can all move smoothly through the changes, aiming for steady growth.

Export commodity prices are affected by many things. These include US money policy, global financial situations, and geopolitical events. Natural disasters and interest rates also play a big role. All of these things change how much people want to buy and sell, which changes the price in the global market.

US money policy can change global prices and how much people are willing to buy. When the US makes it easier to get money, or if there are fewer risks in the world, prices can go up. This often hits countries that are still growing hard.

Countries that are still growing need certain basic products to do well. Because they rely on these products so much, even small changes in global prices can really hurt them. This happens because of US money policy and how the world sees risk.

Interest rates matter because they can change how much it costs to keep items in storage. This, in turn, changes how much people want to buy and sell, which affects the price. They also change how much businesses can spend, which can affect export prices.

The top-down way starts with the market price and then takes away costs. The bottom-up way begins with the costs and adds a set amount to set the selling price. Each method uses a different starting point to find the final price.

Changing exchange rates can make it harder for businesses to plan their prices. Choosing the best currency and ways to deal with exchange rate changes is key. This helps in creating strong pricing plans.

There are ways to lower the risks. Exporting different things can help if one thing’s price drops. Also, using special contracts can help keep prices stable. These strategies protect against sudden price changes.

Looking at past data shows price patterns and how the economy reacted to events. This can help predict what might happen, making it easier to plan for the future. It’s important for making smart trade and policy choices.

New technology is changing how we understand and plan prices for goods. It makes predictions better and helps manage how things are bought and sold. These changes can also help companies earn more money.

Laws and trade deals can change who can sell something, how they can sell it, and its environmental effect. These rules affect how much people want to trade and the prices they get. They make the market more or less fair.

Future trends include laws, new tech, and how policies change. These things will guide shopping strategies and how much countries trade. Being ready and knowing what’s happening is very important for businesses and countries.