Menu

Did you know S&P Global Market Intelligence shares updates on over 100 commodity prices monthly? These forecasts go all the way to 2050. John Anton, with us since 1995, leads in steel and ferrous metals, adding unmatched insights.

Running the Commodities Research, my team focuses on sectors like Automotive and Energy, among others. We check, recheck, and use data thoroughly for investment and price forecasts. By combining sectors, we get a better grip on predicting market changes.

I make sure the data we work with is not just right, but also consistent from different sources. Mixing my in-depth industry knowledge with broader sector views and political stands, we give a full picture in forecasting commodity prices. This helps our clients make decisions with more confidence, ready to face the changes in the market.

Knowing about commodity market updates helps in smart investing. They collect lots of data to give accurate info on market trends. This data is from many sources, making it reliable.

The heart of good market updates is correct data. Data verification checks and organises facts from over 2,000 sources. This accurate info is key for trustworthy commodities price analysis.

| Exchange | Established | Significance |

|---|---|---|

| ICE Futures U.S. | 2007 | Global benchmark for soft commodities like coffee and sugar |

| Chicago Board of Trade (CBOT) | 1848 | Standardised grain futures trading |

| Chicago Mercantile Exchange (CME) | 1898 | Leading derivatives marketplace |

| New York Mercantile Exchange (NYMEX) | 1882 | Leading physical futures market |

Market changes greatly affect prices. Knowing about these shifts is crucial in the market. The Commodity Futures Trading Commission (CFTC) works to make markets more stable.This shows why we need experts to look at everything from politics to the economy. They help us understand how precious metals, for example, protect against inflation.

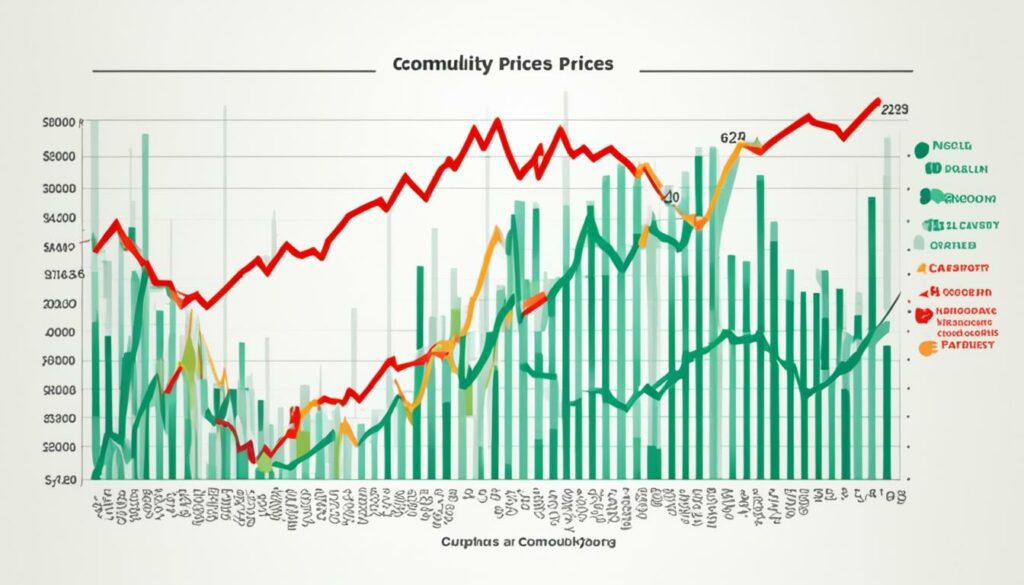

Recent data shows that commodity prices have slowly gone up. However, in 2023, prices only increased by 0.8%. This is much less than the rises in 2021 and 2022.This fluctuation underlines why keeping an eye on commodity prices is so important.

Successful trading analysis turns tricky data into chances for success. This is helped by market intelligence. This lets traders make smart decisions in commodities trading. With support from top research firms like Kpler, used by 10,000+ organisations worldwide, you get unbeatable insights.

In commodity trading, you can leverage about 10% of the contract’s value. This could mean bigger wins with less money invested. It’s better than stocks in some cases. For example, a 20% S&P 500 rise might mean over a 100% profit from a futures contract. This could cost much less than buying all the stocks directly.

Top commodity traders often focus on a single market or a small part for steady profits. This focus, along with cheaper trading fees at discount brokerages, helps. Also, with commodity trading, your money not in use is still available. That’s flexibility for traders.

“Commodity futures trading is simple diversification. It covers agriculture, energy, metals, forex, and stock indexes. This opens up lots of options for traders.”

Strategies that follow trends work well, especially in commodities trading. If you look at how prices move over days, weeks, or months, this can boost profits by around 180%.

Good commodity trading mixes both fundamental and technical analysis. This helps understand prices on the Multi Commodity Exchange (MCX). Also, using automated systems allows for fast trading based on fixed rules.

It’s key to manage risks well to avoid big losses. Tools like stop-loss orders and right position sizes help. Also, watching moving averages and trends closely can improve strategies and market intelligence.

Understanding price trends is vital for those in the commodities market. It teaches us a lot about what might happen in the future. By looking at how prices have changed, we get better at guessing where the market could go next.

Looking at the past helps us decide where to put our money. We’ve seen that commodity prices didn’t change much in 2023. Before then, they went up quite a bit each year.

Gold is a good example. It hit a record high in May 2023, then dropped and went back up. Even with less inflation, gold’s value might not stay as high as before.

We try to guess future prices by mixing old data with new information. Almost 36% of what we pay for things comes from commodities. This includes food and energy, making up a big part of our spending.

Last year, prices hardly increased at all. Food prices went up by a bit. Our predictions also look at what people want to buy and what’s available worldwide. This gives us a wide look at what might affect prices.

| Year | Commodity Price Increase | Notable Trends |

|---|---|---|

| 2021 | 12.1% | Big growth in energy, agriculture, and metals |

| 2022 | 4.8% | Wheat prices spiked |

| 2023 | 0.8% | Gold prices were unstable |

| 2024 (Feb) | 0.3% | Food prices ticked up a bit |

By studying past and using modern tools, we can make better choices in the commodities market. This way, we are ready for what’s coming.

Economic indicators are key in setting commodity pricing. Supply and demand are hugely important. For instance, predictions say energy prices will fall by 3% in 2024, and another 4% in 2025. This is thanks to more supply. These changes greatly affect not only energy prices but also the whole market of commodities.

Currency changes are crucial too. When exchange rates shift a lot, so can the prices of goods. In early 2024, natural gas prices dived in both Europe and the US. The European price fell by 35%, and the US price by 22%. Meanwhile, Brent crude oil prices rose above US$91 a barrel because of rising tensions around the world. This shows how global events can make commodity prices swing sharply.

Inflation is another big player in setting prices. One example is food prices in the US. They went up by 2.2% over 12 months to February 2024. This was more than the overall inflation rate of 3.2%. These inflation bumps can significantly touch off pricing changes. They also have wide impacts on market moves and investment choices.

| Indicator | Impact on Commodity Prices | Example |

|---|---|---|

| Supply and Demand | Drives price increases or decreases | Energy prices forecasted to decline by 3% in 2024 |

| Currency Fluctuations | Affects import and export costs | Natural gas prices plummeted by 35% in Europe |

| Inflation Rates | Inflates commodity costs | Food prices rose by 2.2% in 2024 |

| Geopolitical Events | Causes price volatility | Brent crude oil prices exceeded $91/bbl in April |

Knowing these market indicators is key for smart investing. My strategy bundles these important elements. It gives a whole picture of how economic influence can change the future prices of commodities.

When looking at monthly commodity reports, you see they’re full of info. They help us follow market changes. With Kpler used by thousands worldwide, their impact is huge.

Analyzing reports well means looking at key points. These include understanding supply, demand, and pricing trends. We also look at the specific areas of the world where these commodities are important.

These elements are the heart of our reports. They give solid information for making smart choices.

Forecasting using these reports is really important. By looking at supply, demand, and prices in detail, I can predict changes. Kpler’s monthly reports provide lots of info, keeping me up to date.

Also, getting daily, weekly, and quarterly updates on different commodities is very useful. This info covers things like crude supply, demand, and where trade is happening. It’s essential for making accurate forecasts.

Here’s a table showing different reports Kpler offers and how often they come out:

| Report Type | Timeframe |

|---|---|

| Supply & Demand Forecasts | 18 months and 15 years |

| Price Forecasts | 12 months and 15 years |

| Monthly Outlook Reports | 18+ reports |

| Production, Demand & Price Forecasts | 15 years |

| Daily Product Price Reports | Daily |

| Weekly Regional Reports | Weekly |

From daily prices to long-term planning, these reports are vital. They help us deeply understand the market and make better choices.

Looking at future market trends is key to making good investment choices. By checking how different products are likely to change in price, we can guess what big things might happen in the market.

The World Bank thinks their price index for goods will go down by 4 percent in 2024. This is after a really big 24 percent fall in 2023. Energy prices are likely to drop by 5 percent. Also, the prices of food and other farm products are expected to keep going down.

In the third quarter of 2023, product prices went up by 5 percent. But by the end of October, they were still 29 percent lower than they were in June 2022. That’s not the case for oil. Its price jumped from $72 to over $90 a barrel by the third quarter’s end. However, gas prices in Europe are set to decrease by 4 percent in 2024, joining the energy price drop trend.

When it comes to metals, their prices are likely to go down next year. But in 2025, they might rise by 6 percent. The need for some metals, like cobalt and lithium, is growing. This is because more people are buying electric cars.

We must also look at the big picture. J.P. Morgan thinks it will be tough for stock markets in 2024. They expect the global economy to slow down. This shows why being accurate in our predictions is very important. It helps us avoid mistakes and grab chances.

| Commodity | 2023 Change (%) | 2024 Forecast (%) |

|---|---|---|

| World Bank Commodity Price Index | -24 | -4 |

| Energy Prices | N/A | -5 |

| Agricultural Prices | -2 (Q3) | -3 |

| Metal Prices | -2 (Q3) | -5 |

| Oil Prices (Brent) | $84/bbl (avg) | N/A |

Studying future market trends helps us make better predictions. This is crucial for strong investment planning. It allows us to see big shifts and prepare well for changes in the market.

The commodity market has lots of chances to invest. You can put your money in energy, food, and metals. Knowing the power of these goods is key to making smart money choices.

Things like oil, gas, gold, and silver are worth a lot. Their value as assets has been known for ages. Many people like investing in actual gold or silver bars because they feel safe and protect your money from sudden changes.

One clever way to see what’s a good investment is through futures contracts. With more money, you can win more from how prices change. And, you can also buy stocks of companies that deal with these goods. This makes it easier to spread out your investments. Investing in funds or similar, like ETFs, can also be smart. They help you put your money in lots of different things, sometimes even giving you the chance for more gains.

It’s very important to think about risk when investing in commodities. Using gold as an ‘inflation hedge’ is one way to protect your investment. Spreading your money across different commodities is also wise. This means you’re not only relying on one thing to do well.

If you open a special account for investing in commodities, it’s a bit like a standard account but with extra steps. Making sure your investment follows tax laws is crucial. If you’re saving for retirement, a gold IRA is a safe way to go. It lets you hold actual gold and starts with deposits as low as around $2000.

Putting your money in commodities the smart way can do two things. It can protect what you’ve invested and maybe even make you some extra money. Knowing the best commodities to invest in and how to keep the risks low is very important for success.

| Commodity Type | Investment Vehicle | Risk Mitigation |

|---|---|---|

| Precious Metals | Bullion Bars, Futures Contracts, Gold IRAs | Inflation Hedge, Tangible Asset |

| Energy Products | Futures Contracts, ETFs | Diversification, Market Analytics |

| Agricultural Produce | Individual Securities, Mutual Funds | Portfolio Spread, Industry Expertise |

In today’s market, strategic positioning is key when facing unknowns. With access to data like price forecasts for over 100 commodities, firms gain a better grip on changes. This info, based on the commodities’ past prices, helps make smart choices.

A small steakhouse chain cut costs by $400,000 a year with smart forecasting. This shows just how important deep market analysis is. ArrowStream provides up-to-date reports and personal advice for precise forecasting. These tools help companies stay ahead.

According to CommodityONE, ArrowStream’s insights are essential for understanding and predicting market shifts. Clients of Forecasting Plus highlight the value of monthly reports for planning confidently based on detailed trends.

The promotion of David Cox to ArrowStream’s President aims to boost their market foothold. Church’s Texas Chicken® is also stepping up with a new quality assurance solution to control food expenses better.

Over 10,000 groups rely on Kpler for sophisticated market views. Kpler’s outlooks stretch up to 18 months, with detailed price and balance predictions for items like crude oil and natural gas. Their 15-year price and balance predictions are also a vital tool.

The table below shows how companies use strategy and insights to handle market changes:

| Company | Strategy | Outcome |

|---|---|---|

| Small Steakhouse Chain | Adopted forecasting strategies | Saved $400k per year |

| ArrowStream | Provided daily to quarterly commodity reports and bespoke advice | Enhanced market position |

| Church’s Texas Chicken® | Rolled out quality assurance solutions | Improved food cost management |

| Kpler | Offered in-depth forecasting | Supplied key market insights |

By grasping and using these strategies, firms can skillfully face market changes and hold a strong place.

Mixing politics and macroeconomics in commodity analysis helps us truly see how markets move. The world’s political events and big money trends really influence the prices we see. This makes predicting prices and making smart investments very complex.

Huge world events can change commodity markets a lot. Take how Australia stopped selling copper and coal to China in 2020 over disagreements. This move shows how global tensions can mess with trade and prices. It also reminds us that looking at things like sanctions and deals helps us understand the market fully.

Big money trends are just as important in watching the markets. For instance, we expect the cost of energy and metals to go up in 2024. This will happen because of more mines and changes to how we use energy. Previous data supports using smart models to guess prices. We also must look at things like rising prices and goals for the future.

Our study of commodities mixes too many data types to count. With over 2,000 sources, deep analysis of politics, and focus on big trends, we give a sharp view on where prices could go.

Industry expertise is key for smart *commodity analysis*. It helps us make wise choices. With experts in each sector, we get in-depth analysis of items like metals and energy. This knowledge helps us predict market changes.

Detailed data from 2,000 sources is a big plus. We create a solid database for various commodities like energy and grains.

Energy and industrial metal prices are likely to go up in 2024. Yet, we predict a drop in agricultural prices. Knowing this early on helps us adjust our investment plans. We mix this data with world events to give better advice.

Webinars and updates from different regions also enrich our knowledge. Take Ghana as an example – it’s prime for investment with stable policies and high gold prices. Yet, conflicts like Russia-Ukraine can shake up shipping worldwide. We track these events closely.

Having over 100 sets of monthly commodity prices to 2050 helps a lot. This data dates back to the 1980s. It’s great for making long-term strategies in fields like Agribusiness and Mining. Our reports keep our clients up to date.

To plan well, you must know big economic and energy trends. Expert analysis lets us make forecasts. These insights help us understand where the markets are heading.

For a deep dive, check out a detailed table on how economic points affect commodity prices:

| Economic Indicator | Impact on Commodity Prices | Sector Affected | Strategic Implications |

|---|---|---|---|

| Supply and Demand Dynamics | Significant fluctuations in price based on availability and demand | All commodities | Requires strong forecasting and stock keeping |

| Currency Fluctuations | Changes import/export costs, affecting prices | Energy, Metals | Uses hedging to reduce risk |

| Inflation Rates | Makes production costlier, changing prices | Agriculture, Manufacturing | Adapts pricing models for costs |

Knowing the fine points of each commodity sector means we can deeply understand them. This gives us clear and useful information for stakeholders. Looking closely at different sectors like energy and mining shows us important facts. These include price changes, supply and demand, and what to expect in the long run.

Specialising in energy commodities is key for making the right forecasts. For example, the U.S. saw a big jump in energy product imports, going from $125,911 million to $219,241 million between 2020 and 2021. This was a 74.1% increase. Thanks to OPEC+ keeping production high, they’ve lowered global crude oil prices. Now, oil prices remain steady at $75-$85 a barrel, with $80 forecasted for 2024.

Henry Hub’s natural gas prices have dropped about 40% from the peak seen last year, now at US$2.35/mmbtu. A small rise is expected, up to US$2.40/mmbtu in 2024 and US$3.10/mmbtu in 2025. With low prices and strong LNG deals, the world’s gas demand is set to leap over the coming years.

The metals and mining area shares some key insights for those involved. The U.S. saw its imports go up from $203,832 million to $261,472 million between 2020 and 2021, marking a 28.3% rise. This movement highlights how the metal market reacts to global economic issues very quickly.

Gold has stayed high at around $2,350/oz, with a slight drop to $2,250/oz expected by 2024. Copper prices should hit $4.30/lb by the end of the year, helped by strong demand and limited supply. Prices are set to keep rising through 2025. Aluminium and zinc are also seeing big changes, with aluminium at a yearly high. Zinc is very close to its own high point too. These metals are benefiting from more money coming in and strong global economic growth in early 2024.

Understanding sector-specific commodity analysis is vital for making insightful decisions. It helps us know a lot more about energy and metals. This knowledge guides smart and informed choices.

In recent years, technological advances have made huge improvements in predicting the commodity markets. These advances play a key role in giving us the right information at the right time. This helps businesses make better decisions. Artificial Intelligence (AI) and Machine Learning (ML) are among the tools that make this happen.

CTRM systems have boosted how efficiently and accurately businesses handle their operations. Companies dealing with commodities are always working to make their operations smoother. They do this to make better choices using data that’s up to date.

AI and ML in these systems help businesses find new chances and do better in their day-to-day work. These technologies are great at figuring out complex prices, checking logistics data, guessing incoming goods, and staying up to date with rules. Their impact is clear since they help companies deal with changes and risks in the market.

ION’s FEA tools, for example, help businesses choose wisely with less need for people. Many companies, from various fields, trust ION for managing risks well in the commodity market. These tools bring new levels of understanding and accuracy. They aim to lead the way in how we use technology in the commodities market.

| Technology Integration | Benefits |

|---|---|

| AI and ML in CTRMs | Enhanced forecasting capabilities, improved logistics validation, regulatory compliance |

| Price Forecasting Models | Three-tier price prediction models for commodities like sugar, palm, corn, and soy complex |

| ION’s Analytical Solutions | Intelligent decision-making with minimal intervention, trusted by thousands of corporations |

The cost of raw materials going up is tightening profit margins and raising prices for consumers. A UN report said global food prices in May hit the highest in 10 years. This underlines the need for better technology to forecast prices and their effects on us.

The futures market, full of guesses, is worth ten times more than the actual items traded. This fact shows we need strong forecasting tools for the ups and downs of the market. Companies like Descartes Labs are leading with their accurate predictions for items like soy, palm oil, and wheat.

Using these technological advances is key for the commodities market’s future success. Those who use the best market intelligence technology and forecasting capabilities will be the leaders.

In today’s fast-paced commodity markets, sticking to the best practices is key. They help keep you ahead in the competition. Knowing these well and using them consistently makes your trading plans stronger.

Learning all the time is key to adapting to the market. It’s good to keep up with the latest trends, watch finance videos, and look at financial reports. Pay close attention to the Management Discussion & Analysis in these reports and statements like the 10-K, 10-Q.

Joining yearly calls can tell you a lot about a company’s future. And talking to funds or firms a couple of times a year gives you insights into market trends or specific sectors.

Using up-to-date analytics is crucial for smart moves in a fast market. Live data means you can calculate averages straight away. This method often uses days like 3, 10, or 50.

For a simple 10-day average, you add the last 10 closing prices together and divide by 10. This helps in drawing trend lines, spotting resistance and support levels. It’s all about understanding supply and demand in the market.

It is also important to track major events like policy changes. This includes knowing about tax increases and currency shifts. These can all affect your investment choices and strategies in the market.

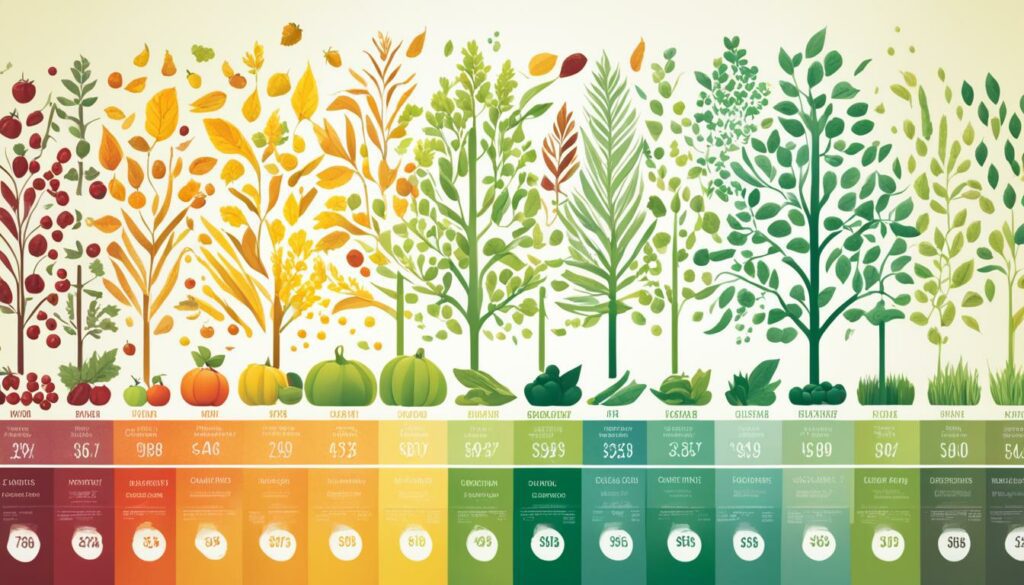

Seasons have a big impact on the prices of goods, making it important to understand when to buy and sell. The price during a season affects payments to farmers. It looks at the average price when the product first changes hands, considering its quality.

Sales data in each state, including future sales, is used for price estimates. These estimates look at sales for each state for at least part of the year. Then, they’re combined to find the national average price for the season.

Calculating the national average price means looking at how much is sold each month. The USDA looks at recent years to figure this out. They then use the real sales data to set the actual price for the season.

The USDA shares this price information to help people understand the market. They also offer tools to predict future prices of important crops like corn and soybeans. Knowing about these trends helps in planning your buying and selling wisely.

Natural gas is set to become the most used energy after 2030. Its price changes a lot because of supply and demand, even more in cold months. The prices go up or down depending on many factors. This can make it hard to know when to make deals.

Corn’s market drops in price during the fall harvest almost every year. But, its value picks back up later, encouraging people to sell from storage. The same goes for soybeans, since their prices change with the seasons and the world’s harvests.

The COVID-19 pandemic in 2020 slowed down the market for a while. Droughts, like the one in 2012, also show how nature can change prices. It’s key to watch these regular changes to make smart decisions and spot any strange price movements.

In conclusion, doing a smart study of markets each month is crucial. We can see many factors influencing prices today. For example, the prices of crude oil changed a lot, staying roughly between $75 and $85 per barrel. This is because of policies by OPEC+ that cut production by about 6 million barrels a day since late 2022. With oil being a bit short, this shows how most countries are obeying these rules well.

Looking at natural gas, its prices at Henry Hub fell by 40% from last year’s high of $3.80 per mmBtu. This happened even though the U.S. kept gas production steady. It shows how global gas needs are expected to grow a lot after a slow 2023. Also, the price of a type of crude from Western Canada, the WCS, is now at $12-$13 per barrel. This is lower than the usual $18-$20 per barrel. These changes bring new things to think about in the market.

The gold market saw a lot of action, with prices staying near $2,350 per ounce. Gold did better than most other materials. World banks are buying more gold, and prices could stay high at about $2,250 an ounce in 2024. They might stay up in 2025. On the other hand, prices for metals used in making things are going up. This is because of a strong need for them and not enough supply. So, knowing about each market and the world’s politics and economy helps people make wise choices.

Accurate data is essential for reliable updates on commodity markets. It is gathered from over 2,000 sources worldwide. This ensures our analysis and insights are trustworthy.

This level of accuracy helps with making informed decisions on strategies. It provides a solid foundation for anyone involved in market analysis and trading.

Market volatility can change commodity prices dramatically. Geopolitical risks and economic changes are key factors. They affect how prices might move over time.

Understanding these factors is crucial for making wise trading decisions. It helps predict how prices might change, guiding your trading strategies effectively.

Successful trading analysis requires turning complex data into clear strategies. It’s about using unbiased research and ongoing market insights. Plus, staying informed on market trends is essential.

With the right information and approach, you can turn data into actionable insights. This can lead to smart trading decisions and better outcomes.

Studying past price movements helps spot patterns. These patterns can show how prices might change in the future. This can be very useful for making investment plans.

Investors use these past patterns to help predict future trends. By doing this, they can adjust their strategies to get better results over time.

Predictive analytics tools are key for guessing future prices. They look at historical and current data. Then, they predict trends based on many market factors.

These tools are a must-have for any serious investor. They help make better-informed decisions, improving the chances of success.

Many things influence commodity prices. These include changes in supply and demand, shifts in currency values, and inflation rates. Knowing these indicators helps guess where prices might go.

Understanding these economic signs is key for anyone investing in commodities. It can make the difference between a good and a bad investment.

Good monthly reports look at what’s driving the market. They also analyse supply, demand, and price trends. Both short-term and long-term movements are important to monitor.

These reports are essential for planning your next moves. They provide insights that can help you adjust your strategies for better trading outcomes.

Market forecasts are based on current and past market conditions. They look at energy, metals, and crops to foresee how prices might change. This gives a detailed look at what to expect in the market.

By using these forecasts, you can better prepare for what’s ahead. It’s a valuable tool for any investor looking to make informed decisions.

To find valuable commodities, look for those with great profit potential. Make sure your investments are well protected against market risks. This approach can help you choose wisely even in uncertain markets.

Identifying the right commodities is crucial for investment success. It requires a careful balancing act between potential gains and the risks involved.

To navigate market changes, you need in-depth insights on global risks and shipping trends. Knowing these can give you an edge and help with smart decision-making.

Understanding the complex world of commodities is key. It ensures you’re prepared for whatever the market throws your way.

Events like new government rules, global tensions, and sanctions can shake up commodity prices. Understanding how these events fit into the market is crucial for a deep understanding.

By looking at political issues, you gain a clearer picture of how the market might move. It’s a vital part of good market analysis.

Big economic trends, like growth rates and policies, can change commodity prices. Knowing about these trends helps with guessing where prices might go. This is important for anyone who invests in commodities.

Analysing these broad economic trends is a key part of understanding the market. It shows the big picture of what’s happening with commodity prices.

Having deep industry knowledge improves commodity analysis. It lets you understand key sectors better. Coupled with risk assessments, it leads to stronger insights and foresight.

This industry insight is crucial for making well-informed choices. It’s a powerful tool for navigating the complex world of commodities.

Looking deeply into sectors like energy and mining gives precise market views. It helps understand the forces that shape prices and trends. This knowledge is crucial for anyone trading in these sectors.

With focused sector analysis, you can make more precise investment plans. It’s all about understanding what’s truly influencing the market.

Technology provides advanced tools for forecasting. It offers precise analyses based on huge amounts of data. These tools are indispensable for accurate market predictions and smart trading decisions.

By using these advanced technologies, you stay ahead of the curve. It’s about having the best tools to navigate the ever-changing commodity market.

Staying up-to-date means always learning and adapting. Real-time data is invaluable for making quick, informed decisions. This constant information flow is vital for staying ahead in the market.

Keeping on top of market changes requires constant vigilance. It’s about being proactive in gathering and interpreting the latest market data.

Seasonal changes, like weather and harvests, can affect prices significantly. Knowing those patterns and cycles can help you time your trades better. It’s key for managing inventory and procurement effectively.

Understanding these seasonal shifts is crucial for making the right moves. It influences when you buy or sell, helping maximise your investments.