Menu

Did you know almost 90% of S&P 500 companies already shared their earnings for the first quarter? Their results were 8.5% better than what experts had predicted. This just shows how important it is for investors and businesses to get accurate weekly price updates.

Today, keeping up with economic indicators and market trend analysis is key. First-quarter earnings for the S&P 500 are likely to increase by more than 10% in 2024. Knowing these trends can greatly affect strategies regarding prices and updates. Getting financial market updates often is crucial to staying ahead of the game.

It’s important to stay updated with weekly price changes. This helps businesses and investors make smart decisions about prices. The market can change quickly, so real-time analysis is key. From my own experience, updating prices on time can lower the risk of sudden market changes.

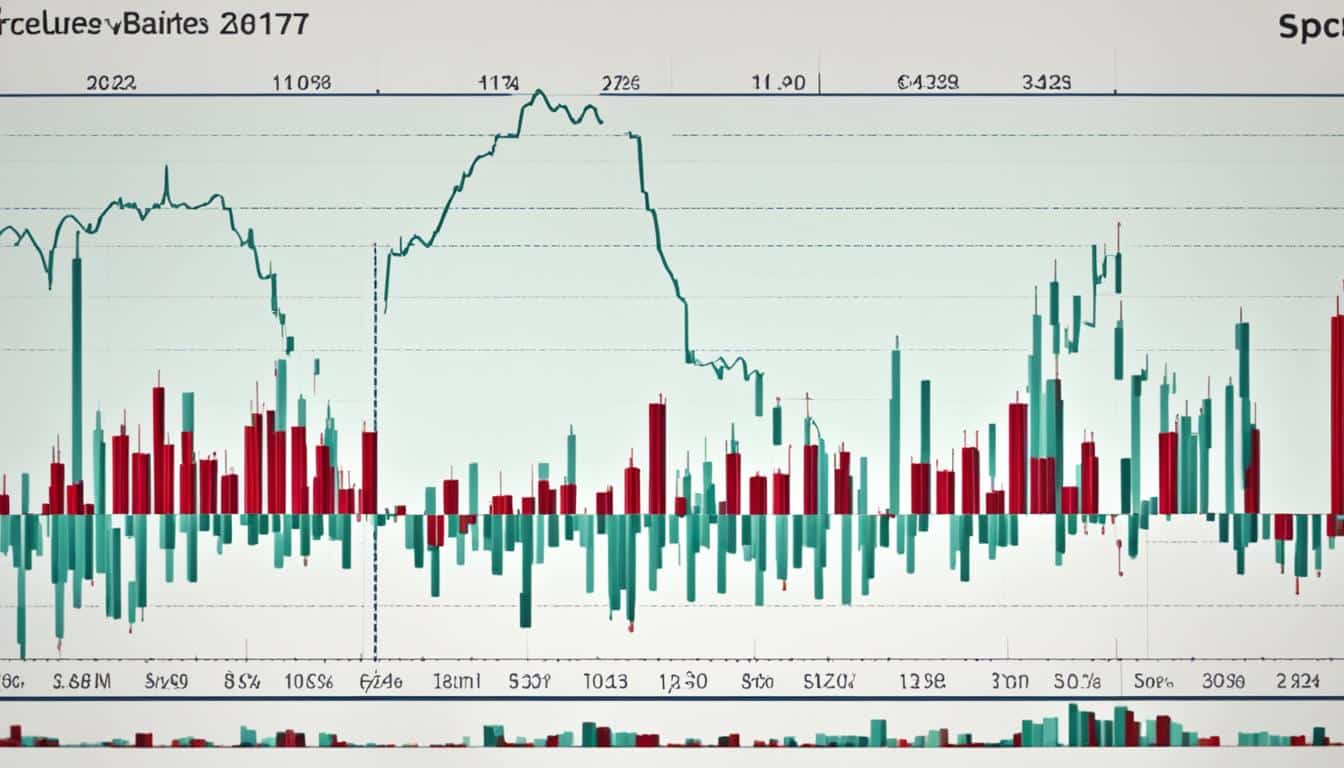

The morning sees a lot of trading activity. Between 9:30 a.m. and 10:30 a.m. ET, day traders find good chances due to high volume. However, the last trading hour can be volatile with more activity. Mondays show a small drop in S&P 500 returns. But this is nothing compared to the big effects seen in September. September can be a tough month, making it a good time for selling stocks.

Real-time analysis gives instant feedback. It allows for quick and smart reactions to market changes. For example, stock prices can go up at the start of a month. This happens because new money comes into mutual funds. Knowing about these trends helps companies protect their investments in a changing market.

| Timeframe | Trading Activity | Implications |

|---|---|---|

| 9:30 a.m. – 10:30 a.m. ET | High Volume and Volatility | Best Hour for Day Trading |

| 3 p.m. – 4 p.m. ET | Increased Volatility and Volume | Strategic Monitoring Required |

| September | Traditionally Weak Returns | Potential Optimal Selling Month |

Knowing about how the market works and using real-time data helps. It shows when to change prices. This makes it easier to deal with the market’s ups and downs.

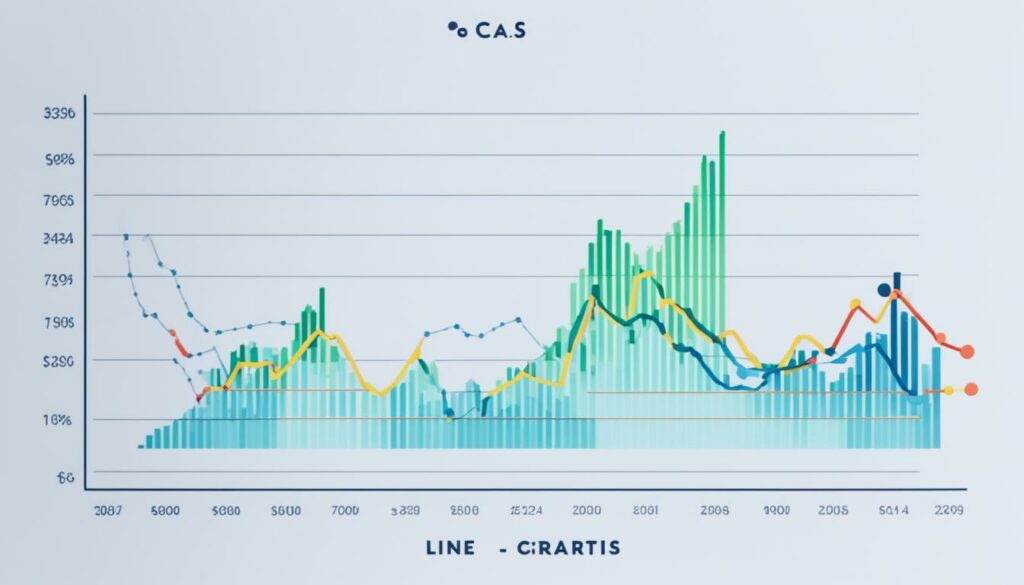

The heart of market trend analysis is grasping how markets act over time. Primary markets have bull and bear phases, each lasting one to three years. In comparison, secular trends are easier to notice because they span one to three decades.

The idea of intermediate trends is easy to understand during bull and bear times. Markets see strong rises in bull times and powerful drops in bear times. In each bull or bear phase, there are three or more intermediate cycles, usually lasting from two to eight weeks. Using tools like the rate of change (ROC) helps in understanding where a trend is going and how long it might last.

Market trend analysis focuses on three main types of trends:

To work with these trends, there are different tactics. Strategies like Moving Averages, Momentum Indicators, and Trendlines & Chart Patterns are key. For example, the Moving Averages method suggests buying when a short-term average goes over a long-term average. It advises selling when the opposite happens.

Knowing about sector performance helps figure out how different parts of the economy do in various market situations. This knowledge helps spot chances or risks, making decisions better. Watching sector performance guides investors towards areas that might provide the best returns.

Yet, trend analysis does have its critics. It relies on past data, which isn’t always a perfect future guide. They say that markets generally are smart, and past trends don’t always show what will happen. Also, different stats can lead to different conclusions, possibly missing outside influences on the market.

Understanding all types of trends well is crucial for good economic forecasts and assessing sector success. This leads to more thought out pricing and investment plans.

Understanding how economic indicators affect prices is key for planning. By looking at these indicators, businesses and investors can make smart choices for the future. They can adjust to different economic situations easily.

The Consumer Price Index (CPI) shows how prices for goods and services change over time. A detailed

gives us insight into how inflation affects different areas. For example, checking current CPI data helps spot inflation’s impact on what people spend and what businesses pay. Knowing this, and that inflation data is usually later news, we get a sense of the lasting effect of economy shifts on prices.

The Federal Reserve uses CPI info to try and keep inflation close to 2% by making certain decisions. This shows how important CPI is for making policies to steer the economy right.

Changes in interest rates, set by central banks, really shake up market prices. As interest rates climb, it costs more to borrow money. This means less spending by people and businesses.

But, if interest rates go down, it makes borrowing cheaper and encourages spending. These fluctuations are clues to the overall health of the economy. Take the U.S. unemployment rate at 3.9% in February 2024. This information hints at possible interest rate changes to keep the economy moving steady. How these rates affect things like mortgage costs and stock profits is a big part of understanding market trends.

Economic indicators, whether they look ahead or look back, are crucial for knowing the market. Considering things like CPI and interest rate changes together helps predict and adapt to shifting prices. Detailed reports, like the Beige Book and the Consumer Confidence Index, are also valuable. They offer more data for making strategic choices in the fast-changing finance world.

It’s key for businesses to grasp why prices change in various sectors. By looking closely at prices, we can see what causes them to go up or down. Dive with us into the world of industry prices and market trends for a better understanding.

Sectors are performing differently, some growing strong while others are declining. This quarter, parts like communication services and consumer goods are doing well. But, areas like energy and healthcare are not earning as much.

“The S&P 500 earnings are estimated to grow around 10% this year, with earnings exceeding analyst estimates by 8.5% for the first quarter.”

However, energy and materials sectors are facing big challenges from the wider economy. The table below shows the up and down in earnings for each sector:

| Sector | Earnings Growth (%) | Key Driver |

|---|---|---|

| Communication Services | 15% | Digital Demand |

| Consumer Discretionary | 12% | Rising Consumer Spending |

| Technology | 14% | Innovation and Dependence |

| Energy | -5% | Macroeconomic Challenges |

| Materials | -3% | Supply Chain Issues |

| Healthcare | -2% | Regulatory Pressures |

The analysis shows that sectors focusing on new ideas and what people want now are doing best. But, those sticking to old ways face tough times. This change is a reminder to companies—they need to be quick to respond to new challenges.

Looking forward, it is said that earnings will grow over 10% in 2024. Almost all S&P 500 companies have shared their first quarter earnings. This points out the need for businesses to change and adapt to survive.

In short, knowing why prices change in different sectors is crucial for every business. Keep up with market trends to grow effectively. Stay informed to spot new chances for success.

Finding the right pricing update frequency is key to a good pricing plan. Real-time updates help you stay ahead, especially in a fast-moving market.

In today’s market, using real-time pricing can be a game-changer. This method suggests the best prices immediately. It can consider if products are available and how customers behave. Studies show that businesses quick to adjust prices, especially when inflation hits, can keep up better.

Using computer models to analyse past sales, competitor prices, and buyer trends leads to better, real-time pricing choices.

Even though real-time updates are vital, having a regular update schedule helps too. A weekly check can make your business more flexible. It lets you make tweaks without causing chaos. This approach blends quick reactions with a steady way of updating prices.

| Update Frequency | Benefits | Challenges |

|---|---|---|

| Real-time | Optimal pricing, market responsiveness | Complex to manage, requires robust infrastructure |

| Weekly | Balanced approach, systematic updates | May lag in rapidly changing markets |

By using both dynamic pricing and weekly checks, companies can make smart decisions. This dual strategy helps beat the market’s ups and downs.

Stock market analysis is key now. First-quarter results show the S&P 500 could grow about 10% this year.

About 90% of S&P 500 companies have shared first-quarter earnings. These were 8.5% better than expected. They also grew 5.5% from last year. Revenues are expected to grow by about 4%.

An interesting thing is that usually, earnings estimates drop by 4% each year. But this year, estimates for 2024 have stayed the same. Some sectors, like communication services and tech, are doing very well. They expect earnings to rise more than 10% in 2024.

The 10-year Treasury yield rose to 4.7% but then fell below 4.5%. Analysts think CPI will drop to 3.4% and core CPI to 3.6%. Used car prices are falling, but rent prices have not changed much.

Over the past three years, mid-cap stocks rose by 10%. The S&P 500 rose by 25%. It shows different trends. The S&P 500 is nearly at its highest point ever.

Even though stocks fell on Wednesday, other indices had big changes. The DJIA ended the week at 39,512.84, up by 837.16 points. The Nasdaq was at 16,340.87, with an increase of 184.54.

Global markets had mixed results. The FTSE 100 reached a new high, jumping by 2.68%. Japan’s stocks fell slightly. Yet, Chinese stocks went up after the Labour Day holiday. The Shanghai and Hang Seng indices rose, highlighting growth in the region.

Looking at all this analysis, it’s clear investment trends will have a major impact soon. Keeping up with these trends is important for smart investing decisions.

Inflation’s effects on market prices are complex and significant. Between June 2022 and December 2023, U.S. inflation dropped from nearly 9% to 3.4%. These changes are key in affecting future pricing trends and market values.

By the end of 2023, market segments showed different price movements. Energy prices fell by 2%, but food prices rose by 2.7%. The core inflation rate, not counting food and energy, jumped by 3.9%. This shows how diverse inflation’s effects can be. For example, fuel oil prices fell by 14.7%, while motor vehicle insurance rose by 20.3%.

Looking ahead, it’s crucial to grasp future inflation rates. The Consumer Price Index (CPI-U) hit 306.7 in December 2023 after nearly tripling in four decades. Price changes averaged 19% higher than in December 2019. This understanding helps in making smart plans. It includes considering wage growth, which was 16.2% from 2021 to 2023 but slightly less than the 17.1% price increase.

| Category | Percentage Change (Dec 2023) |

|---|---|

| Energy Prices | -2% |

| Food Prices | 2.7% |

| Core Inflation (excluding food and energy) | 3.9% |

| Fuel Oil | -14.7% |

| Motor Vehicle Insurance | 20.3% |

Ongoing tracking and understanding of inflation are crucial. Despite easing inflation, buying power dropped by 0.9% compared to mild wage growth. This info helps in making future-ready economic strategies smarter.

Recent data show an interesting link between GDP growth and pricing power. Business investment, especially in equipment, saw a 2.1% boost. This is a sign of a strong economy.

The first quarter of 2022 saw a big jump in technology investment. This area is growing fast, showing we depend more on tech. Also, people have been buying homes a lot, with residential investment up by 13.9%.

But not all is perfect. A drop in business stocks slightly lowered GDP growth. On the bright side, exports increased by 0.9%. Yet, imports also went up, by 7.2%, showing lively global trade.

| Economic Metric | Q1 2022 Growth |

|---|---|

| Real Business Fixed Investment | 2.9% |

| Business Equipment Investment | 2.1% |

| Information Technology Investment | Significant Increase |

| Real Residential Property Investment | 13.9% |

| Business Inventories | Down, reducing GDP by 0.35% |

Sales to local private buyers went up by 3.1%, showing strong consumer demand. This helped raise prices, especially in services where they increased by 4%. This was the fastest rise since the pandemic.

Also, real incomes and spending have slightly gone up in March. This shows the economy is getting stronger. It hints that prices could keep going up in many areas.

It’s key to know what affects price changes for investors and businesses. Things like supply chain breaks and shifts in demand are very important. They can really change the market balance.

Breakdowns in the supply chain can mess up pricing strategies. If there’s a problem from getting raw materials to delivering the final product, prices can go up. Companies use AI these days to foresee such issues. This way, prices can be changed quickly and efficiently.

For example, shops look at past sales and what rivals are pricing to set their own prices better. They’re always checking and fixing their prices, especially when inflation rises. This shows how responding fast is super important to keep the market stable.

Changes in how much people want something can also alter prices. Things like new consumer habits, the time of year, or big economic trends can affect what’s popular. By keeping an eye on what prices competitors have, companies can stay in the game. This isn’t just about keeping a price higher than others. It’s about understanding when and how to adjust based on many things.

Modern pricing doesn’t just look at what rivals are doing. It also considers if products are easily available and what shoppers are into. Doing live market checks helps businesses set prices that match what people are looking for now. This keeps them competitive.

| Factor | Impact on Pricing | Example |

|---|---|---|

| Supply Chain Disruptions | Prices go up when there’s not enough to go around | Raw material transport delays |

| Demand Changes | Prices shift with what people want | Higher prices at Christmas |

| Competitor Pricing | Change prices quickly to keep up | Lowering prices to compete |

In the end, understanding supply and demand and the factors that influence prices is vital. Using smart analytics and models can help in a changing market.

It’s crucial for any business looking to do well in strategic planning to know the value of price forecasting methods. Predictive analytics has changed how we make market predictions. It lets companies see and handle future market conditions better.

By using AI algorithms to look at past trends, global events, and more, businesses can guess future prices very well. This deep look at data makes for smart buying decisions. Companies can then spend their money wisely and cut down on risks.

Price forecasting also involves making guesses about future supply trends. This helps with predicting and getting ready for potential price changes. Knowing roughly how much product is left, thanks to ending stock forecasts, helps in making long-term plans.

AI platforms like Vesper make strategic planning even better. They provide exact forecasts that let companies change their trading plans ahead of time. This keeps them ahead in the market.

Good forecasting and planning depend on mixing future guesses and market data, keeping an eye on trends, and using AI well. AI can be a big help by looking at things like big political events and what people are buying. This gives traders a big leg up in a complex market.

| Forecast Type | Benefits |

|---|---|

| Production Forecasts | Predict future supply trends, prepare for price fluctuations. |

| Ending Stock Forecasts | Estimate remaining supply, aid long-term planning. |

| Sales Forecasting | Estimate future revenue, predict market responses. |

Being able to guess your future sales well is key to planning. It lets businesses know what to expect. This can make private companies more confident and public companies look better.

In short, using great price forecasting methods and predictive analytics can do wonders for a business’s planning. It stops them from making big mistakes. This helps keep their profits safe and their growth steady, even in a tough market.

Price volatility is key in changing markets. It includes swings in prices over the short and long term. These affect how people invest and manage risks. Studying these changes helps us understand market analysis better and make strong risk plans.

Short-term spikes in prices come from things like seasonal changes in what people need and quick supply changes. For example, in winter, the cost of energy like gas and heating oil can jump. The variability in their prices can almost double, making them riskier investments in the winter. This happens because the amount of gas stored and ready for use can change a lot, affecting the prices.

| Factor | Volatility During Winter | Volatility During Other Months |

|---|---|---|

| Average Monthly Volatility Index | 104% | 49% |

| Natural Gas Spot Price Changes | High | Moderate |

| Natural Gas Storage Levels | Influences Price Significantly | Less Significant Influence |

Such sudden changes mean we need strong ways to manage risks. This can help us avoid big losses and even make money from these price jumps. Knowing about these short-term moves is key in getting good at analysing market changes.

Long-term changes look at production, imports, and bigger economic situations. Let’s take the case of natural gas in 2002. Its production dropped by 3 percent and imports fell too. By the end of February 2003, the amount of gas stored was over 40 percent lower than usual.

These factors led to big price swings in the gas market that year. A similar story happened with oil prices. The price jumps were quite high compared to earlier years. This shows why we need to keep a careful watch on markets and be ready to change how we invest with time.

The link between how much gas is stored and its price shows why we need to watch these trends closely. It tells us when prices might jump too high or drop too low. This close watch helps us make smart moves in the market.

Dealing with short and long term price changes needs a detailed risk plan. It’s about being ready for any market situation. This way, we stay strong and can adjust to changing times in the market world.

Knowing about industry-specific pricing helps you stay ahead in your market. Predictions show S&P 500 company earnings will rise by over 10% in 2024. Sectors like communication services, consumer discretionary, and technology are growing fast. Their earnings are up by about 4%. This means making smart price changes is very important.

An in-depth market sector analysis helps uncover the reasons behind price shifts. The transportation services index rose by 11.2%, showing big price changes there. On the other hand, medical care services only saw a 2.7% increase. This shows the changing competition among healthcare providers.

Competitive pricing needs to consider the economy too. The drop in headline and core CPI, as well as lower used car and rising rent prices, suggests that prices are evening out. This is a good time for companies to tweak their prices as needed.

“Understanding these sector-specific price updates enables businesses to tailor their strategies, maximising profitability while navigating the dynamic market environment,” I stressed.

Here’s a detailed comparison of price changes in various sectors:

| Sector | Price Index Change (%) |

|---|---|

| Communication Services | 4.0 |

| Consumer Discretionary | 5.5 |

| Technology | 6.0 |

| Transportation Services | 11.2 |

| Medical Care Services | 2.7 |

This data clearly shows the importance of understanding industry-specific pricing. By carefully analysing their market sectors, companies can set prices that work well with the current economy and trends in their industry.

It’s crucial to understand how corporate earnings affect market prices for wise investing. Recently, S&P 500 companies did better than expected, with first-quarter results 8.5% above forecasts. This trend is great news for market growth, with expectations of a 10% rise in S&P 500 earnings this year alone. The strong financial performance of these companies clearly shows how significant earnings are for price changes.

Big firms have revealed their latest earnings, showing varied outcomes. Walmart’s net income tripled to $5.1 billion in the last quarter, pushing its stock up by 7%. On the other hand, Cisco saw a 13% fall in revenue, reflecting in a 2.7% stock price decline. These scenarios depict how earnings directly shape market shifts and investor confidence.

Analysts expect good things for the S&P 500 in 2024, with over 10% earnings growth. Sectors like communication services, consumer discretionary, and technology will lead this charge. This outlook differs from the usual downward revisions, showing a positive scene. Lower inflation and potential interest rate drops are factors to consider. Knowing these forecasts will help investors make the right moves in the stock market.

Weekly updates are key for understanding market shifts. They keep everyone up to date on the latest data. This information helps businesses and investors make smart choices.

Staying ahead of market changes keeps you in the game. It helps protect your investments. Reacting quickly to price changes keeps your strategies in line with the market.

Having current price info lets people act fast. Quick choices mean more profit and lower risk. This approach is a great defence against market ups and downs.

Knowing market trends allows for better planning. It helps in setting the right prices and investments. This leads to wise choices and better money results.

CPI and inflation have a big say in market prices. They show what prices might do in the future. This info guides businesses and investors in their decisions.

Interest rate changes can affect how much we spend and invest. This, in turn, changes market prices. Knowing these effects can help predict future prices.

Different sectors see prices change for different reasons. Understanding these differences is key. It helps handle each sector’s unique challenges.

Updating prices every week keeps you on top. Real-time and structured updates make a big difference. They help you stay competitive and make more money.

The stock market has seen changes in how investments and earnings grow. Keeping up with these trends is important for investors. It helps them plan their next moves.

Inflation pushes up costs and affects what we can buy. This, in turn, changes market prices. Knowing about inflation helps plan for these shifts.

Growing economies can make markets more confident. But, too much growth can make prices unstable. Balancing these points helps companies predict prices.

Changes in supply and demand shake the market. Knowing these factors helps businesses stay balanced. It lets them quickly adjust to price shifts.

Forecasting prices predicts where the market is heading. This knowledge is key for planning ahead. It helps businesses match their prices to future trends.

Short-term ups and downs bring immediate challenges and chances. Long-term trends help in making plans. Both are necessary for managing risks well.

Sector-focused updates make you a standout in your industry. They provide vital insights. Understanding your market sector well is crucial for success.

These reports show a company’s financial health. They immediately affect stock prices. Predictions about future earnings also guide investors.